Private Companies: Embracing Change, Driving Growth

Claire Shaw – Portfolio Director

- The Scottish Mortgage portfolio includes groundbreaking private companies, such as SpaceX, Zipline and Climeworks

- Bridging the private-public divide, Scottish Mortgage gives shareholders the opportunity to benefit from long-term compounded returns

- Providing purposeful capital supports the companies driving technological advances and societal progress

As with any investment, your capital is at risk.

What are the implications of eliminating the dead zones that prevent a quarter of the US from getting mobile phone signals? And what if we could solve problems in seconds that would take today’s supercomputers decades?

Perhaps we’ll soon find out, thanks to private companies in Scottish Mortgage’s portfolio.

Speaking at the Trust’s inaugural digital conference, manager Tom Slater and deputy Lawrence Burns shared why holding companies across the private-public divide gives shareholders exposure to a differentiated and diversified returns.

Watch the full discussion

Tom Slater, Lawrence Burns and Claire Shaw discuss why owning public and private companies in one fund is a unique proposition. Plus updates on SpaceX, Northvolt, blockchain.com and more.

A catalyst for growth

With companies staying private longer, Scottish Mortgage gives its clients a low-cost way to tap into the value accruing in unlisted companies without locking them in.

Scottish Mortgage can invest up to 30 per cent of its value in private companies, as measured at the time of investment. It currently backs 40 private companies, the 10 largest of which account for two-thirds of the 23 per cent exposure.

Since 2012, , the Trust has deployed £4.6bn of capital to 46 companies. Of those, 14 – including Spotify, Wise and Tempus AI – have successfully floated and remain in the portfolio. Others, including ByteDance, SpaceX and Epic Games have thrived while remaining outside public markets.

“We’re looking for private growth companies, those with the potential to be multiples of their size over our investment horizon,” said Burns.

“Our role is to provide capital that’s a catalyst to that growth, to help continue and accelerate it.”

That means that most private capital is deployed when companies’ business models have established a path to profitability and are beginning to scale.

Occasionally, the Trust will take smaller holdings in earlier-stage companies, such as UPSIDE Foods. Conversations with their founders help the managers understand emerging industries and spot further opportunities.

The rewards for scaling the heights

SpaceX is Scottish Mortgage’s largest private holding, accounting for just over 4 per cent of the portfolio.

With close to 100 launches last year, SpaceX has more than doubled the number of launches in 18 months. Its new skyscraper-sized vehicle, Starship, can take 150 tonnes into orbit, allowing its clients to deploy larger, more complex and capable satellite systems.

Slater also highlighted the potential of SpaceX’s satellite internet business, Starlink. With over three million subscribers in 100 countries, its ability to provide high-speed data connectivity to remote and rural areas worldwide is a substantial competitive advantage.

In addition, Spotify illustrates why bridging the private-public divide can create long-term compounding returns. Scottish Mortgage first invested in 2015 at about $56 a share, then in a subsequent funding round in 2017 and again when it listed in 2018 at about $130 a share. Earlier this year, the Trust sold some shares at about $300.

Those early years allowed the managers to know the company better and build close relationships with its leaders. Today, they are among a select group who are invited to meet founder Daniel Ek one-on-one.

Pioneering a better world

Companies developing innovative energy transition solutions could have enormous societal impact.

Redwood Materials, for example, is recycling lithium-ion battery components to help others provide lower-cost energy storage for electric vehicles and renewables.

The primary capital that Scottish Mortgage and other provided helped the firm fund facilities in Nevada and South Carolina. Last year, these could process about 40,000 tonnes of material, enough to build batteries for approximately 100,000 electric cars.

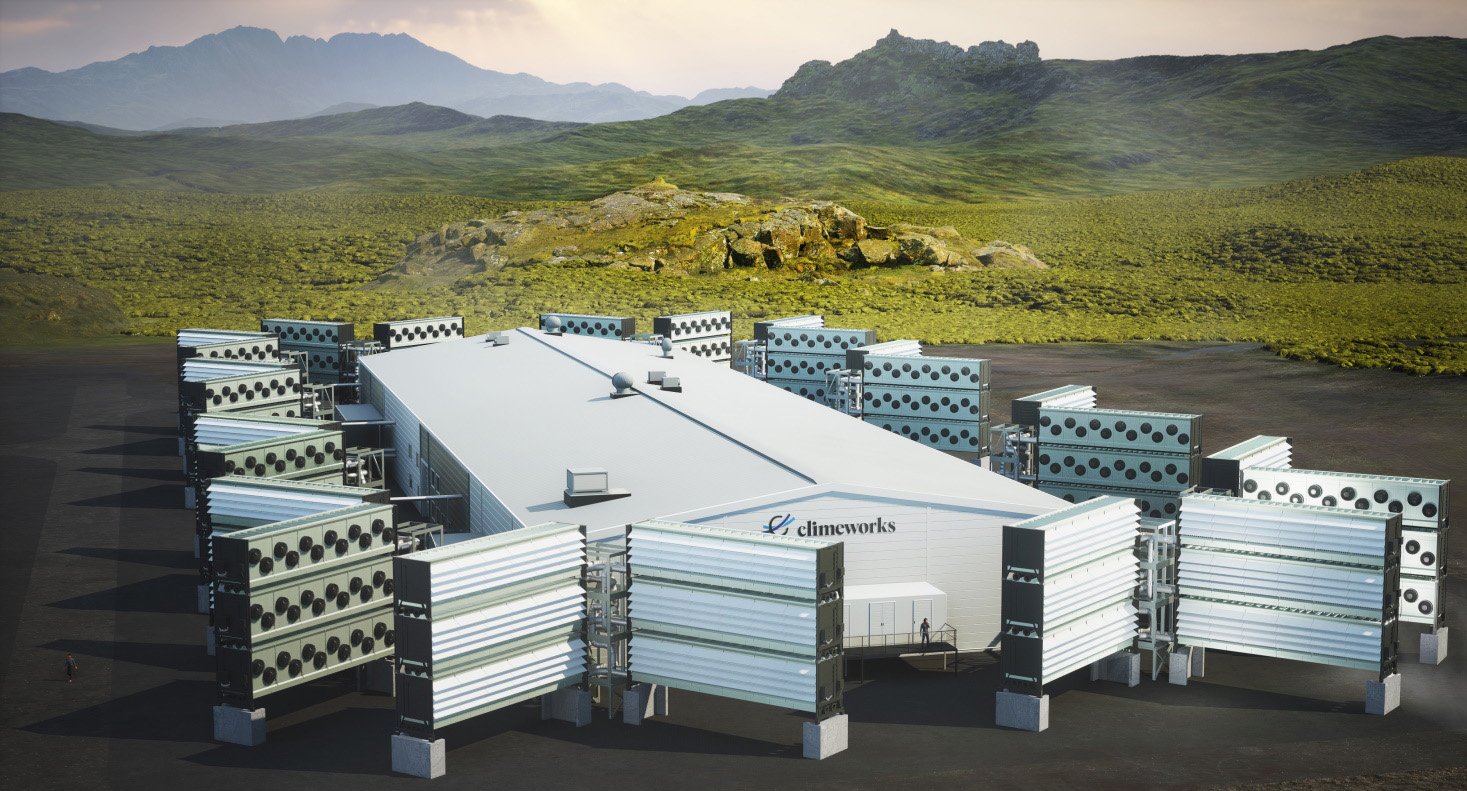

Climeworks is also building what could become a multi-billion-dollar industry: carbon removal. Scottish Mortgage contributed to the funding of two Icelandic facilities, which are sucking carbon dioxide out of the atmosphere for underground storage.

“[Achieving scale] could have a material and financial impact on shareholders, but it is also possible that if they succeed, they will change the world,” said Burns.

Slater referred to Northvolt, the European champion in battery technology, which has seen intense Asian competition and a slightly cooling demand in Europe for electric vehicles. These factors have led to a challenging period which the managers are monitoring closely.

The return of the IPOs

Slater explained that various macro variables, including confidence and interest rates, determine the pace of IPOs (initial public offerings).

There was “a huge appetite for companies growing very quickly but not profitable three or five years ago. As a company, being profitable or having a clear path to profitability has become an important variable.”

He is optimistic about the outlook, partly due to the “huge pipeline of companies that have effectively been trapped for the past three years, where pressure is building to move and transition to a public company.”

A recent positive was Tempus AI listing at a valuation of circa $6bn. It helps healthcare professionals better diagnose and treat cancer and other diseases.

Purposeful capital

Purpose takes many forms. Sometimes, emerging technology makes a difference in unexpected ways.

Having survived the downturn in crypto markets over the past three or four years, Blockchain.com benefits from an enhanced competitive position.

Slater recounted how its technology, used alongside Starlink’s internet connectivity, makes it possible for Sub-Saharan African villages to install a solar facility to provide their energy needs while running a crypto-mining machine that pays for the installation.

Elsewhere, PsiQuantum is developing quantum computers that would make today’s supercomputers positively slow. Faster drug development, better fertilisers and superior battery chemistries are just a few of the end possibilities.

Holding companies with such world-changing potential across the private-public divide extends the window for long-term compounding returns. But there’s more.

Capital becomes truly purposeful when it goes directly to companies to accelerate progress. It is one reason why private companies addressing change can meaningfully drive growth and contribute to shareholder returns over the long term.

Risk Factors

Unlisted investments such as private companies, in which the Trust has a significant

investment, can increase risk. These assets may be more difficult to sell, so changes in

their prices may be greater.

The trust invests in overseas securities. Changes in the rates of exchange may also cause

the value of your investment (and any income it may pay) to go down or up.

About the author - Claire Shaw

Portfolio Director

Claire Shaw is a portfolio director and plays a prominent role in servicing Scottish Mortgage’s UK shareholder base. Before joining in 2019, she spent over a decade as a fund manager with a focus on managing European equity portfolios for a global client base. With a background in analysing companies and communicating investment ideas, Claire is also responsible for creating engaging content that makes the Scottish Mortgage portfolio accessible to all its shareholders. Beyond that, she works closely with the managers, meeting with portfolio companies and conducting in-depth portfolio discussions with shareholders.

Regulatory Information

This content was produced and approved at the time stated and may not have been updated subsequently. It represents views held at the time of production and may not reflect current thinking. Read our Legal and regulatory information for further details.

A Key Information Document is available by visiting our Documents page. Any images used in this content are for illustrative purposes only.

This content does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned. The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the FCA.

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 (BGA) holds a Type 1 licence from the Securities and Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes and closed-ended funds such as investment trusts to professional investors in Hong Kong.

Baillie Gifford Asia (Singapore) Private Limited (BGAS) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. BGA and BGAS are wholly owned subsidiaries of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co.

Europe

Scottish Mortgage Investment Trust PLC (the “Company”) is an alternative investment fund for the purpose of Directive 2011/61/EU (the “AIFM Directive”). Baillie Gifford & Co Limited is the alternative investment fund manager (“AIFM”) of the Company and has been authorised for marketing to Professional Investors in this jurisdiction.

This content is made available by Baillie Gifford Investment Management (Europe) Limited (“BGE”), which has been engaged by the AIFM to carry out promotional activities relating to the Company. BGE is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform promotional, advisory and Individual Portfolio Management activities. BGE has passported its authorisations under the mechanisms set out in the AIFM Directive.

Belgium

The Company has not been and will not be registered with the Belgian Financial Services and Markets Authority (Autoriteit voor Financiële Diensten en Markten / Autorité des services et marchés financiers) (the FSMA) as a public foreign alternative collective investment scheme under Article 259 of the Belgian Law of 19 April 2014 on alternative collective investment institutions and their managers (the Law of 19 April 2014). The shares in the Company will be marketed in Belgium to professional investors within the meaning the Law of 19 April 2014 only. Any offering material relating to the offering has not been, and will not be, approved by the FSMA pursuant to the Belgian laws and regulations applicable to the public offering of securities. Accordingly, this offering as well as any documents and materials relating to the offering may not be advertised, offered or distributed in any other way, directly or indirectly, to any other person located and/or resident in Belgium other than to professional investors within the meaning the Law of 19 April 2014 and in circumstances which do not constitute an offer to the public pursuant to the Law of 19 April 2014. The shares offered by the Company shall not, whether directly or indirectly, be marketed, offered, sold, transferred or delivered in Belgium to any individual or legal entity other than to professional investors within the meaning the Law of 19 April 2014 or than to investors having a minimum investment of at least EUR 250,000 per investor.

Germany

The Trust has not offered or placed and will not offer or place or sell, directly or indirectly, units/shares to retail investors or semi-professional investors in Germany, i.e. investors which do not qualify as professional investors as defined in sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB) and has not distributed and will not distribute or cause to be distributed to such retail or semi-professional investor in Germany, this document or any other offering material relating to the units/shares of the Trust and that such offers, placements, sales and distributions have been and will be made in Germany only to professional investors within the meaning of sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB).

Luxembourg

Units/shares/interests of the Trust may only be offered or sold in the Grand Duchy of Luxembourg (Luxembourg) to professional investors within the meaning of Luxembourg act by the act of 12 July 2013 on alternative investment fund managers (the AIFM Act). This document does not constitute an offer, an invitation or a solicitation for any investment or subscription for the units/shares/interests of the Trust by retail investors in Luxembourg. Any person who is in possession of this document is hereby notified that no action has or will be taken that would allow a direct or indirect offering or placement of the units/shares/interests of the Trust to retail investors in Luxembourg.

Switzerland

The Trust has not been approved by the Swiss Financial Market Supervisory Authority (“FINMA”) for offering to non-qualified investors pursuant to Art. 120 para. 1 of the Swiss Federal Act on Collective Investment Schemes of 23 June 2006, as amended (“CISA”). Accordingly, the interests in the Trust may only be offered or advertised, and this document may only be made available, in Switzerland to qualified investors within the meaning of CISA. Investors in the Trust do not benefit from the specific investor protection provided by CISA and the supervision by the FINMA in connection with the approval for offering.

Singapore

This content has not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this content and any other content or material in connection with the offer or sale, or invitation for subscription or purchase, of the Trust may not be circulated or distributed, nor may be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor (as defined in Section 4A of the Securities and Futures Act 2001, as modified or amended from time to time (SFA)) pursuant to Section 274 of the SFA, (ii) to a relevant person (as defined in Section 275(2) of the SFA) pursuant to Section 275(1), or any person pursuant to Section 275(1A), and in accordance with the conditions specified in Section 275 of the SFA, or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Where the Trust is subscribed or purchased under Section 275 by a relevant person which is:

(a) a corporation (which is not an accredited investor (as defined in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or

(b) a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary of the trust is an individual who is an accredited investor, securities or securities-based derivatives contracts (each term as defined in Section 2(1) of the SFA) of that corporation or the beneficiaries’ rights and interest (howsoever described) in that trust shall not be transferred within six months after that corporation or that trust has acquired the securities pursuant to an offer made under Section 275 except:

(1) to an institutional investor or to a relevant person or to any person arising from an offer referred to in Section 275(1A) or Section 276(4)(c)(ii) of the SFA,

(2) where no consideration is or will be given for the transfer;

(3) where the transfer is by operation of law; or

(4) pursuant to Section 276(7) of the SFA or Regulation 37A of the Securities and Futures (Offers of Investments) (Securities and Securities-based Derivatives Contracts) Regulations 2018.