Affirm

On a mission to enhance consumers' financial wellbeing through honest financial products

Image credit - © Affirm

What does it do?

Financial technology platform which provides lending and consumer credit services.

Why do we invest?

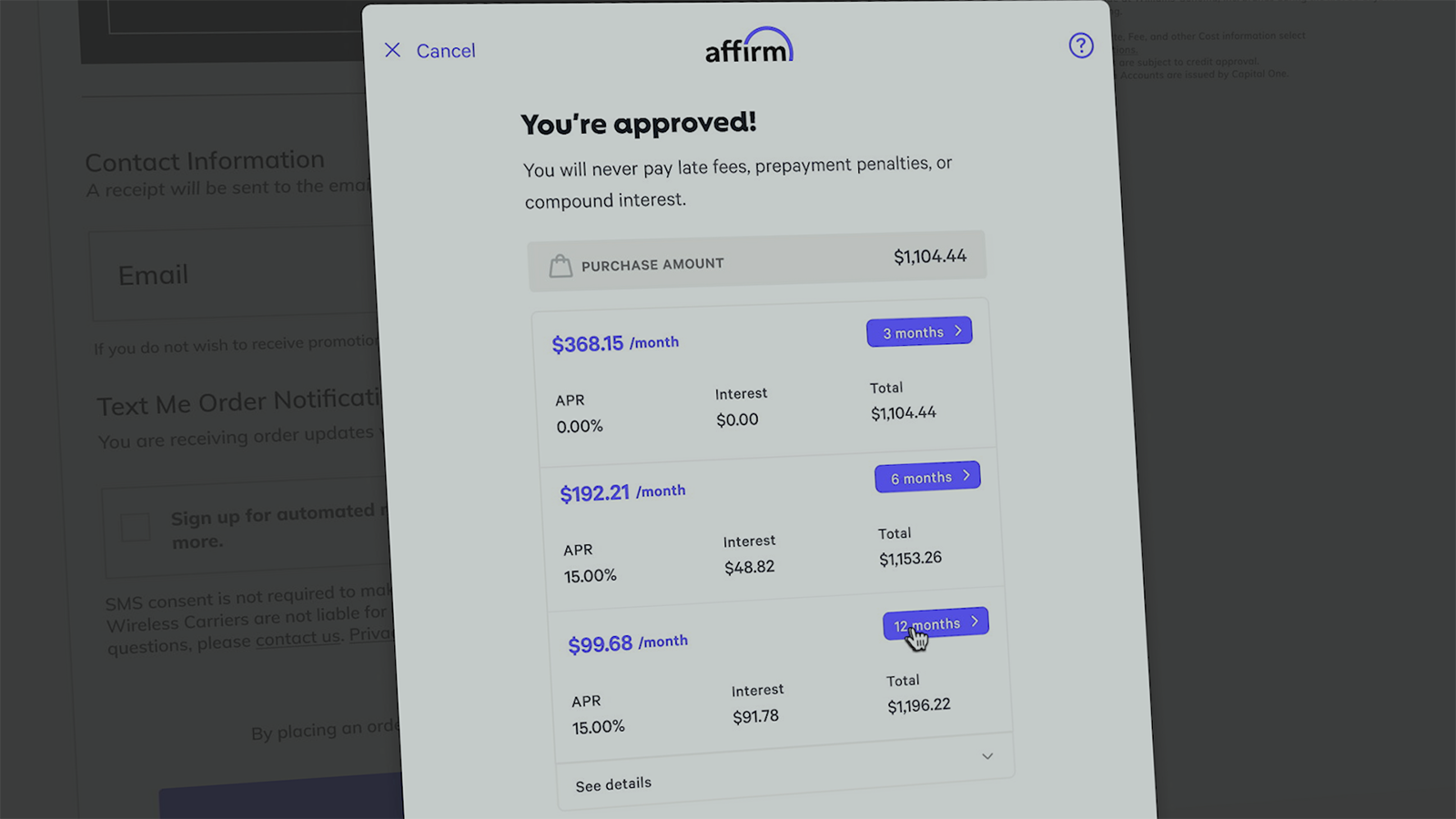

Affirm is a consumer finance company offering simple, transparent products using digital technology. It eschews traditional finance practices such as hidden or late fees because of the belief this creates misalignment between the lender and the consumer. Affirm also uses machine learning to improve its underwriting capabilities.

Affirm’s first product was point-of-sale credit through online merchants. This cost-effective way to acquire customers gives it a platform to build its brand while spending almost nothing on marketing. Its second product, a debit ‘plus’ card has also landed well with consumers.

Affirm has consistently had its Net Promoter Score in the 70-80 per cent range, which is rare for any company, let alone a financial services company. This provides a strong foundation for Affirm to deeper integrate themselves in the financial lives of their customers and merchants.

It currently has partnerships with Amazon, Shopify and Stripe, the digital payments company, meaning Affirm addresses most of US ecommerce.

Who is key?

Founder CEO Max Levchin, one of the co-founders of PayPal and the co-creator of the CAPTCHA security technology. Part of the inspiration for starting Affirm came from his own negative experiences as a borrower in the US. He started Affirm with a mission to treat customers fairly, something that many lenders fail to do.

When

Founded in: 2012

Invested in: 2019

Went public: 2021

Where

Headquartered: U.S.

Listing status

Public

Important information

The company showcased on this page is part of a diversified portfolio. The commentary should not be taken as advice on an individual stock.

Investment trusts are UK public companies and are not authorised and regulated by the Financial Conduct Authority. You may not get back the amount invested and please bear in mind that past performance is not a guide to future performance.