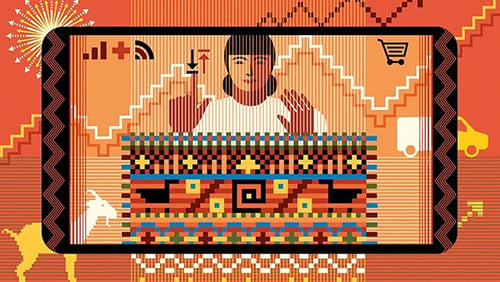

MercadoLibre

Democratising commerce and promoting financial inclusion in Latin America

Image credit - © Newscast/REX/Shutterstock

What does it do?

MercadoLibre hosts the largest ecommerce and payments ecosystem in Latin America.

Why do we invest?

Ecommerce penetration in Latin America has lagged behind other regions due to poor product ranges, long delivery times and high costs. MercadoLibre solves these problems by providing users with a reliable digital commerce platform, improved logistics and affordable finance.

In most Latin American countries, you will find an oligopoly where three or four banks control around 80 per cent of the market, catering only for the wealthy and charging some of the highest fees in the world. MercadoLibre, which translates as ‘free market’, has delivered reliable, low-cost financial services to all, including the previously unbanked. In doing so, it has allowed millions more across the region to pay and be paid, to borrow, lend and invest.

While the roots of the business lie in ‘Marketplace’ – the online ecommerce platform – MercadoLibre’s operations spread throughout the region’s nations and business sectors to make it one of the most valuable companies in Latin America. From Pago, the fintech platform, to Envios, the logistics service, this company is at the forefront of the secular shift to the online world.

Who is key?

MercadoLibre is founder-run with chief executive Marcos Galperin still at the helm, supported by long-standing executives. The company's culture is rooted in a willingness to delay profitability and invest in building its platform given that its time horizon is the next 15 years, not just the next three or four. The management team want to build a legacy.

When

Founded in: 1999

Invested in: 2020

Where

Headquartered: Brazil

Listing status

Public

Important information

The company showcased on this page is part of a diversified portfolio. The commentary should not be taken as advice on an individual stock.

Investment trusts are UK public companies and are not authorised and regulated by the Financial Conduct Authority. You may not get back the amount invested and please bear in mind that past performance is not a guide to future performance.