October 2022

Article

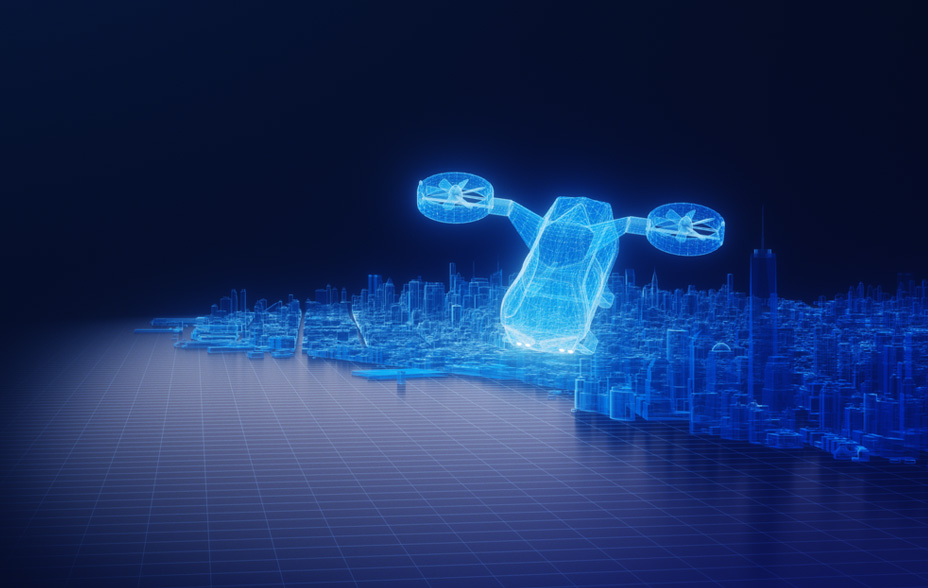

The future of transport – the possibilities are electrifying

The Scottish Mortgage Team

Key Points

- The future of mobility is about encouraging new, more efficient and sustainable forms of transport

- Speed, safety, comfort and consumer cost will be important factors

- Companies such as NIO, Joby and Nuro are transforming how we travel, which could rewrite the future of urban geography

The future can’t come fast enough. Before Tesla, the traditional auto industry was stuck on a slow road to decarbonisation. Then along came Tesla. Because it didn’t have to distance itself from the internal combustion engine, it could do what other automobile makers could not – design an electric vehicle from scratch, without worrying about how it might affect their existing business.

As a result, Tesla, and subsequently NIO in China, are continually raising the world’s expectations, not only of what an electric vehicle can deliver, but also what it means to own and operate a car in the 21st century.

But imagining the future of mobility is not just about the cars we drive. It’s about encouraging new, more efficient and sustainable forms of transport more broadly.

As traffic congestion increases, even with more sustainable electric vehicles on the roads, part the answer could be up in the air. If flying taxi pioneer Joby or Lilium can make good on Joby’s motto “to save one billion people one hour per day”, we might be flying high for short commuter trips in busy metropolitan areas sooner than expected.

Speed, safety, comfort and consumer cost will all be important factors in the shaping the future of travel. Take Nuro’s self-driving vehicles, designed to transport objects and not people. With no passengers to protect, they can be smaller and nimbler.

These companies could have a major bearing on the future of urban geography. They too are examples of the beneficial, transformational change that Scottish Mortgage seeks to encourage and support. Tesla sums it up just so, “Electric cars, batteries, and renewable energy generation and storage already exist independently, but when combined, they become even more powerful – that’s the future we want.” It’s the future we at Scottish Mortgage want too.

All investment strategies have the potential for profit and loss. Your or your clients’ capital may be at risk.

About the author - The Scottish Mortgage Team

The Scottish Mortgage team are dedicated to servicing existing and prospective shareholders of the trust.

Important information

This communication was produced and approved at the time stated and may not have been updated subsequently. It represents views held at the time of production and may not reflect current thinking.

This content does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned. The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the FCA.

A Key Information Document is available by visiting our Documents page.

Any images used in this content are for illustrative purposes only.