May 2022

Article

Patient green capital

Claire Shaw – Portfolio Director

Overview

Companies need time to develop carbon-cutting disruptive innovations. By providing patient capital you can increase both their environmental impact and your returns, as Scottish Mortgage Investment Trust’s Claire Shaw explains.

The value of shares in Scottish Mortgage, and any income from them, can fall as well as rise and investors may not get back the amount invested.

What is the greater challenge to decarbonisation? The speed at which we need to find breakthrough innovations to reform carbon-intensive sectors at scale or the patience investors require to fund the companies set to do just that?

It’s a trick question. They are two sides of the same coin. If we are to limit global warming to 1.5-degrees, the world will have to decarbonise at 13 per cent a year – over eight times the rate historically achieved since 2000. Thankfully, we can already see a new generation of entrepreneurs forming, primed to find solutions in carbon-intensive sectors. Over the next decade, their business models and drive will be key to triggering the tipping points that will invite further investment and thus accelerate adoption.

The first step will be securing significant funding from a particular breed of investor. Decarbonising technologies typically take longer to develop and scale than traditional ‘digital’ technology offerings. Investors need to be prepared to show more patience with their capital than they might do with more established industries. Scottish Mortgage can provide that patient capital, which will be integral in enabling this new wave of companies to achieve the exponential growth needed to make meaningful steps towards decarbonisation.

Funding the next generation

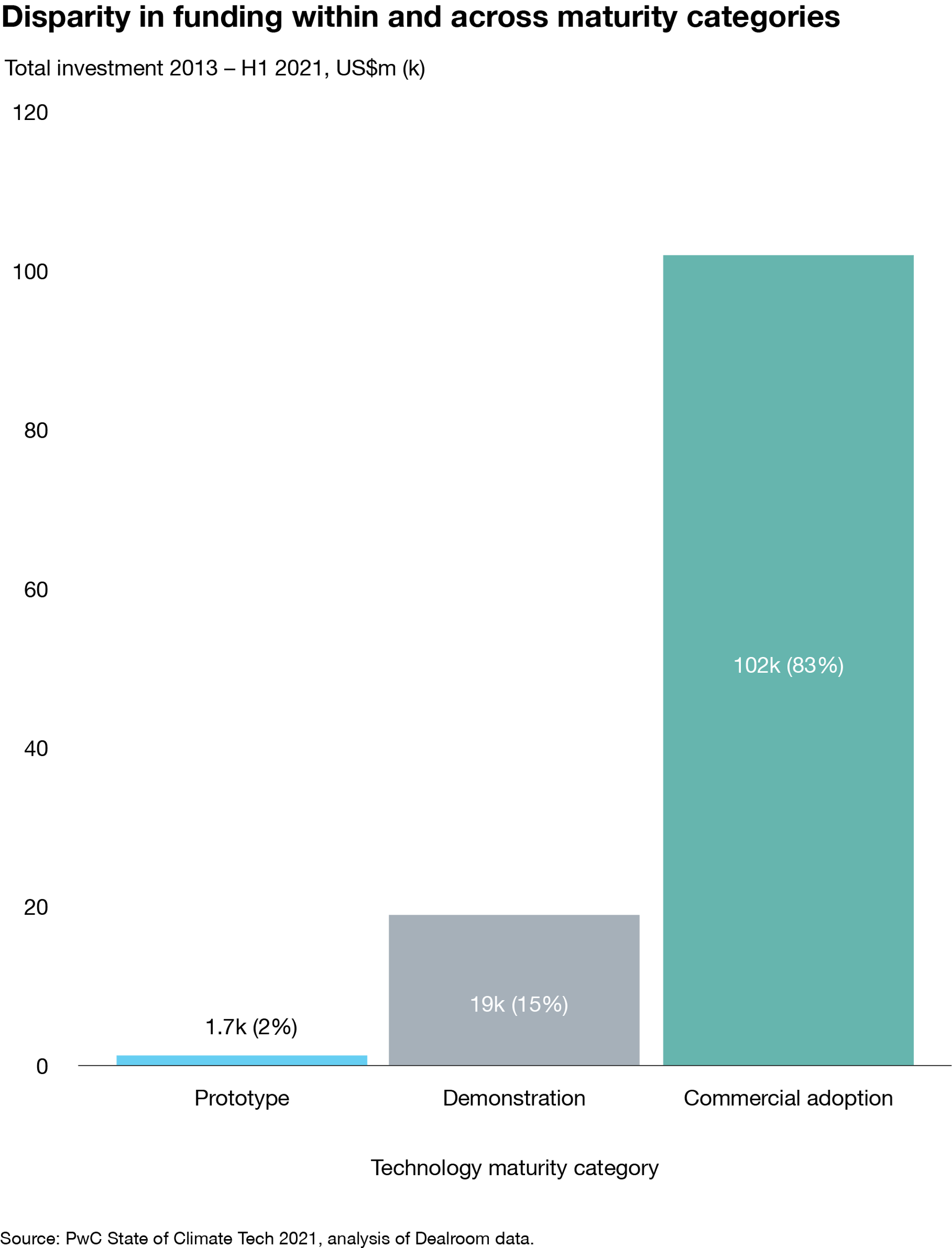

A recent study showed that to achieve net zero by 2050, approximately half of global CO2 emissions reductions will come from technologies that are currently only at the prototype or demonstration stage. But while there is a rapid increase in the number of companies hoping to shake up high-carbon industries, few are ready to do so at scale. Out of the 1,200 global ‘unicorns’ – private companies valued at more than $1bn – a meagre 78 have decarbonisation at the heart of their business model. Put another way, for every venture capital dollar spent in 2021, only 14 cents was put into this field. This will need to change. We need to put more funding into the right companies if they are to have the time and space essential to developing their technologies.

The first generation of ‘decarbonising’ unicorns have already successfully set the stage for what can be achieved with the right combination of entrepreneurial talent, patient capital and a long-term time horizon. Tesla epitomises this. It demonstrated beyond doubt that disruptive innovative products can also deliver a substantial positive, sustainability impact. But, at Scottish Mortgage, our mission does not stop there. Our focus is on finding the next generation of companies to build on the momentum set by their predecessors. Scottish Mortgage is committed to identifying the talent pool of innovative founders who understand the challenges ahead but also are not scared to take on solving these challenges over the next decade and beyond.

The next generation of green technologies

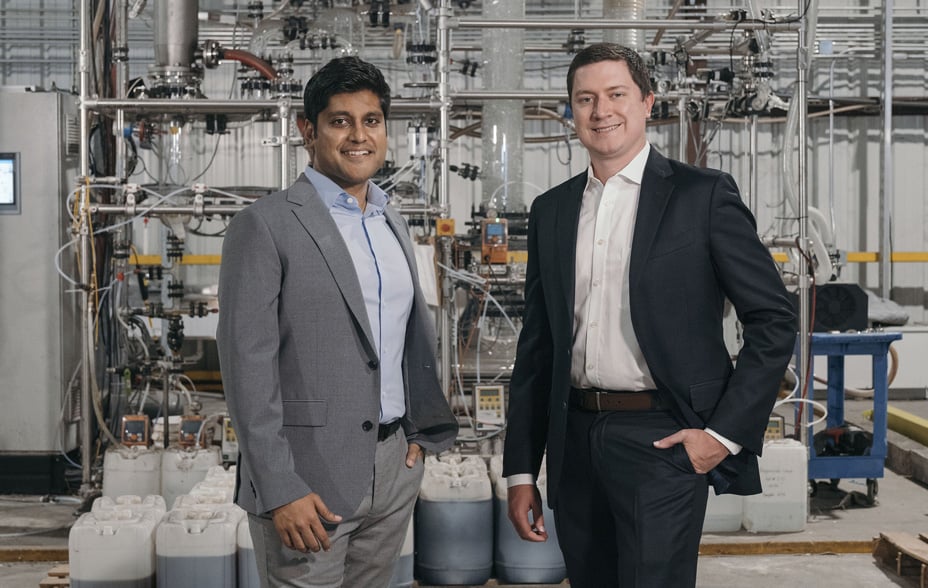

Solugen, for example, is a highly ambitious and potentially transformational business, ready to meet the challenge of decarbonising the chemicals industry. Using synthetic biology, it has created a platform to make cleaner chemicals by moving away from carbon-based inputs. The chemicals industry is colossal at almost $6tn a year. But it is also one of the dirtiest, responsible for 30 per cent of all global carbon emissions. Solugen could have a significant impact if it succeeds in cleaning up the chemicals industry.

Another company tackling global warming from a different angle is Climeworks. Its carbon capture plant, Orca is situated just outside Reykjavik, Iceland and is currently the largest installation in the nascent ‘direct air capture’ industry. This technology aims to remove carbon dioxide from the atmosphere. Once sealed underground, the gas becomes ‘negative emissions’. This is a potentially essential but underdeveloped method for tackling global warming.

On the outskirts of the Arctic circle in a small city in northern Sweden lies one of the most ambitious renewable energy projects in the world. Northvolt has begun building Europe’s largest lithium-ion battery manufacturing plant, which will be powered by 100 per cent clean energy. Where it leads, others will follow. But in the meantime, it takes vision and foresight on the company’s part, and understanding, patient capital from investors to see this through.

Supporting the green industry to scale

Solugen, Climeworks and Northvolt share a similar challenge – scale. Scaling these infrastructure companies is going to need support in a different way from their ‘digital era’ predecessors.

The structure of traditional venture capital strategies was well suited to digital business models. Because digital technology scales easily, investors can make a swift exit within the typical 10-year fund life. However, investing in decarbonisation technologies is going to require longer time scales and potentially different investors. These will be investors – including Scottish Mortgage – whose philosophy and fund structures can match the time horizons required to support these companies as they deal with the challenges of high upfront costs.

Investors will need to have courage and assume the risk hurdle of moving away from the safe sanctuary of scaling digital technologies. Venture cap funds will need to be lured away from focusing on areas with demonstrated success and a healthy pipeline of late-stage funding.

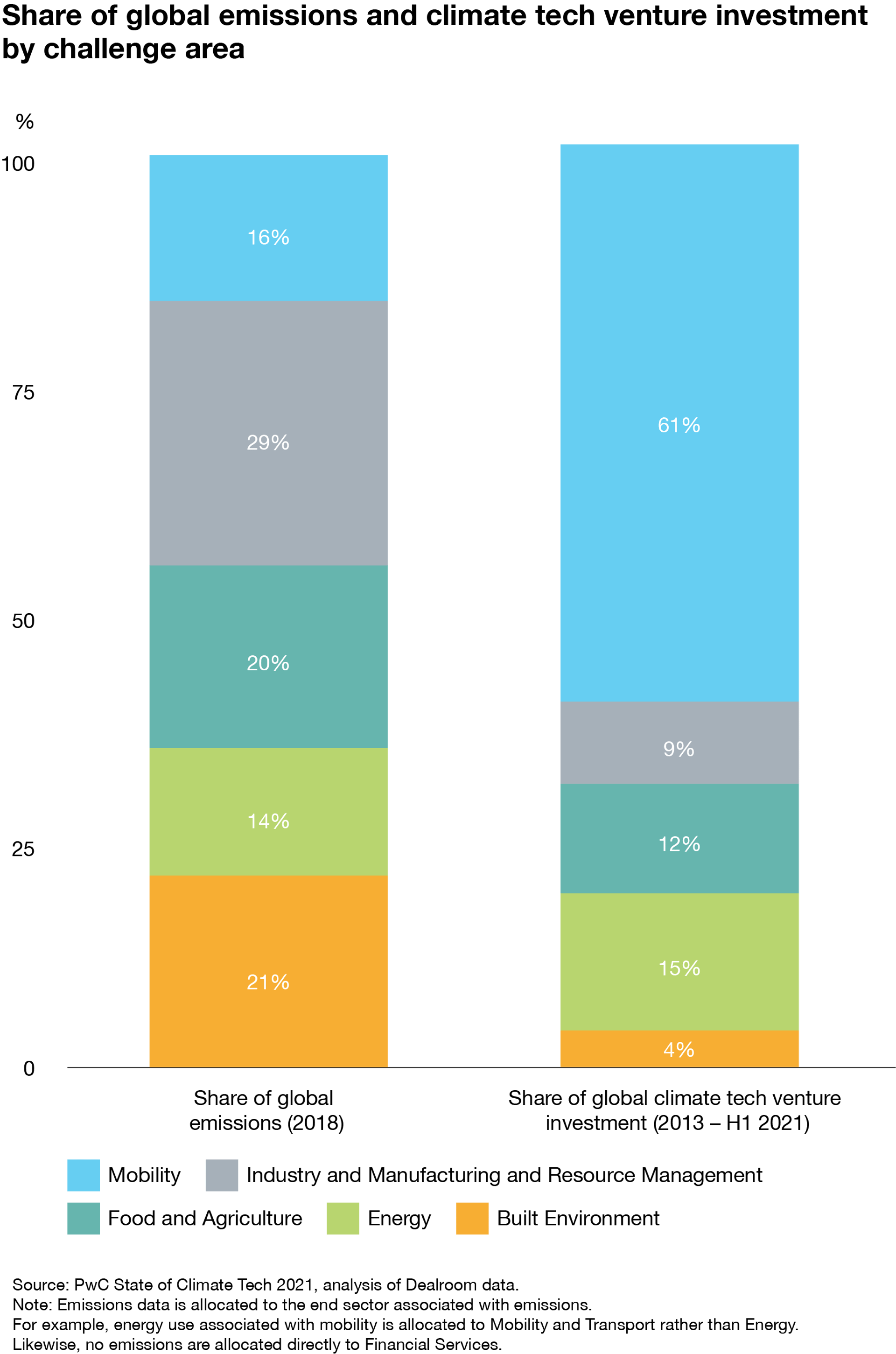

The sooner technologies, such as those being worked on by Solugen, Climeworks and Northvolt, can achieve scale, the greater the total emissions reduction potential for our society. As it stands there is a mismatch between the proportion of capital in the private markets allocated to decarbonisation and the respective share of global carbon emissions depreciation they contribute to.

Scaling may be a challenge for the three companies, but they are fortunate in that they share a similar attribute – they have been created and are run by founders who are not afraid of the challenges that lie ahead. While the investment community may have some apprehension about the lack of track record many of these founders have in the deep understanding of decarbonising technologies given its nascency, we are buoyed by the interdisciplinary nature of this space and what solutions a fusion across industries can create.

Solugen’s founders Gaurab Chakrabarti and Sean Hunt epitomise this fusion in action. The former a physician scientist, the latter a chemical engineer – are testament to how the cross-pollination of ideas from other industries can lead to radical thinking and solutions. We believe this is what makes a company like Solugen special, in that they have combined two viewpoints from completely different ends of the scale spectrum and in doing so have arrived at a fundamentally different way of viewing the emissions problem inherent in the chemicals industry. Unlike more defined areas such as software or biotech, the companies at the forefront of the energy transition – like Solugen – are going to depend on several different talent pipelines. We as investors should be encouraged to look beyond traditional ‘sector silos’. Addressing climate change is going to need more holistic thinking as it is a complex, cross sectoral problem.

Green capital

If we are to decarbonise at speed and scale, it’s crucial that we also identify the commercially viable opportunities that aren’t yet picking up the capital, but which could have significant impact.

The excitement around certain technologies, particularly in the transport sector is high, chiefly down to the success of Tesla. As a result, these companies have attracted significant capital and a greater proportion of the funding. Within the Scottish Mortgage portfolio, we have several of these companies: Nuro’s revolutionary fully electric, self-driving delivery bots, Joby and Lilium who are leading the pack in electrifying urban air transport, Zipline who are using drones to deliver medical supplies are just a few.

There is a frenzy of capital chasing companies trying to disrupt transport. But we picked these firms with care based on their fundamental business characteristics and potential to generate outsized returns. As ever, we are highly selective about where we allocate capital, identifying the best companies to invest in based on years of research and meetings with company executives, academics and others with valuable insight. But increased funding is needed across many other industries. They may not have the same track record as transport, but could potentially have a proportionally greater impact in reaching our emissions targets.

Financial returns for positive impact

The examples above take us back to the underlying purpose of the financial markets, which many participants have largely forgotten. The provision of patient aligned capital to help transformational companies scale is the essence of investing in progress.

For Scottish Mortgage, our investments in these companies are driven both by a desire to have a positive impact and the potential to make significant financial returns for our shareholders. We see it as our mission and duty to provide primary capital to businesses, by directly funding investment in future economic growth. Aligning investment capital with environmental impact can maximise future progress, which can only be good for our shareholders, our society and our planet.

Risk factors

The trust invests in overseas securities. Changes in the rates of exchange may also cause the value of your investment (and any income it may pay) to go down or up.

The trust invests in emerging markets where difficulties in dealing, settlement and custody could arise, resulting in a negative impact on the value of your investment.

The trust has significant exposure to private companies. The Trust’s risk could be increased as these assets may be more difficult to buy or sell, so changes in their prices may be greater.

About the author - Claire Shaw

Portfolio Director

Claire Shaw is a portfolio director and plays a prominent role in servicing Scottish Mortgage’s UK shareholder base. Before joining in 2019, she spent over a decade as a fund manager with a focus on managing European equity portfolios for a global client base. With a background in analysing companies and communicating investment ideas, Claire is also responsible for creating engaging content that makes the Scottish Mortgage portfolio accessible to all its shareholders. Beyond that, she works closely with the managers, meeting with portfolio companies and conducting in-depth portfolio discussions with shareholders.

Important information

This communication was produced and approved at the time stated and may not have been updated subsequently. It represents views held at the time of production and may not reflect current thinking.

This content does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned. The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the FCA.

A Key Information Document is available by visiting our Documents page.

Any images used in this content are for illustrative purposes only.