March 2023

Article

6 minutes

Ocado’s robot retail revolution

Faith Glasgow – Journalist

Key Points

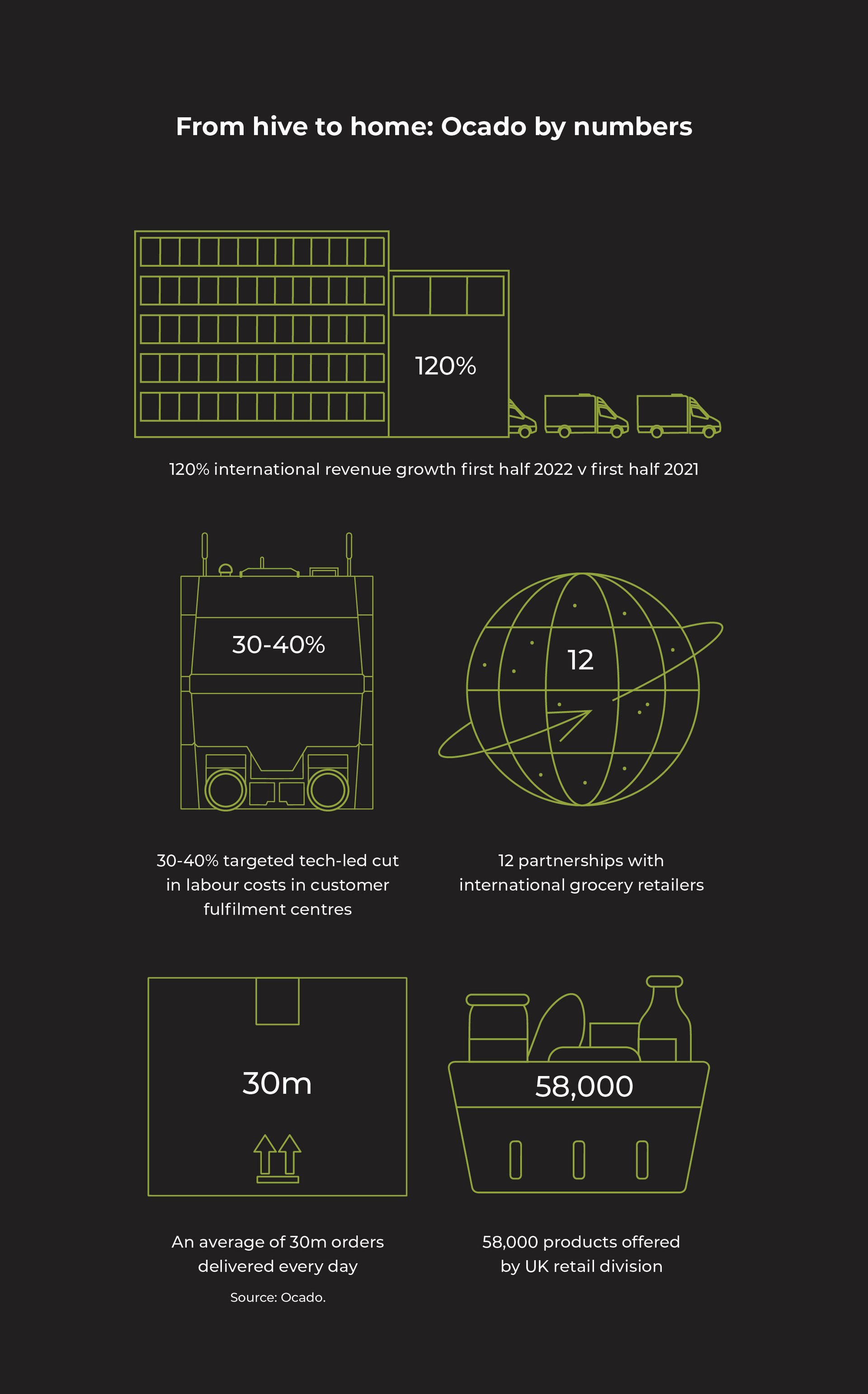

- Ocado is building robotic warehouses across the world in partnership with leading global grocers

- These tie-ups let the firms pool resources to accelerate technological innovation to cut the cost of home deliveries

- Ocado only has to capture a small fraction of the overall market to thrive

Ocado’s 500 Series bots at work in Purfleet, Essex. © Ocado Group

Please remember that the value of an investment can fall and you may not get back the amount invested. This article originally featured in Baillie Gifford’s Spring 2023 issue of Trust magazine.

A mix of automation and artificial intelligence will transform the way we shop within decades. You can see global retail’s future being tried and tested in Andover, a small Hampshire town.

In a warehouse bigger than three football pitches, a swarm of squat, rectangular robotic trolleys blink, pause and glide their way across a giant grid known as ‘the hive’. Around the clock, they collect crates containing tea, Jaffa cakes, toothpaste and cabbages stored below and ferry them to picking stations for packing.

A custom-built traffic control system choreographs this jerky hi-tech ballet at a speed, scale and complexity beyond any human intelligence. “Wifi and 4G [were] incapable of providing the amount of messaging to the amount of independent devices with the frequency that we wanted to do,” CEO Tim Steiner recently told Scottish Mortgage’s Invest in Progress podcast.

“So we created this system to allow us to communicate with the robots frequently enough to know where they all are 10 times a second.”

Using the robots, Ocado takes less than five minutes to prepare a 50-item order. In the average week, the site processes about 60,000 requests from shoppers.

At the end of 2022, Ocado had 19 such customer fulfilment centres (CFCs) in operation, with plans to open dozens more.

“A coming together of technologies makes this possible: data processing, robotics and autonomous decision making,” says Claire Shaw.

“What excites us about Ocado is that it benefits from the scale of the international grocers it partners with, so it’s able to invest in technology on a level that few others can match.”

The firm’s new 600 Series robots are a case in point. The machines use 3D-printed components, making them cheaper to manufacture and 80 per cent lighter than their predecessors. That means they can run on more lightweight grids, cutting the cost and construction time of new fulfilment centres.

© Ocado Group

Meanwhile, investment in software has led to innovations such as Ocado Swift Router. Overnight, it prepares deliveries that customers booked days in advance. Then, on the morning of the drop-offs, it plots van routes that accommodate last-minute orders on the same vehicles. Shaw explains: “The schedules prioritise the urgent orders while ensuring those with longer lead times still get delivered at the requested hour. This innovation helps its partners offer a premium fast-delivery service at a lower cost than would otherwise be the case.”

Steiner founded the company in 2000 with the help of two other ex-Goldman Sachs bankers. The firm began trading in 2002 in a groceries-selling alliance with the UK supermarket chain Waitrose.

A stock market flotation followed in 2010. Three years later, Ocado struck its first deal to provide its automation technology and online platform to another retailer, Morrisons, which uses them to run its own-brand ecommerce business. Similar tie-ups followed with France’s Groupe Casino, Sweden’s ICA and Canada’s Sobeys in 2018.

In 2020 Marks & Spencer replaced Waitrose as Ocado’s British groceries partner. A further seven overseas partners now make use of its Ocado Smart Platform technologies, including:

- Aeon in Japan

- Coles in Australia

- Kroger in the US

- Lotte Shopping in South Korea

Ocado is already committed to operating more than 60 robot-served customer fulfilment centres. But that figure could be dwarfed by what’s to come.

The global grocery market was worth more than $11tn in 2021. Even if Ocado succeeded in getting 1,000 CFCs up and running, it would still account for less than 5 per cent of that sum.

“There’s still a very long runway of opportunity,” Shaw says. “And as the world’s largest online-only grocery business, Ocado is in a powerful position to build its knowledge and improve efficiency.”

By further optimising its performance, the firm should help its partners cut waste and other costs, leading to lower prices for shoppers.

“It’s an industry that’s measured in the trillions, and it’s an industry that spends probably about a third of its sales on handling and distributing its products,” Steiner told Invest in Progress. “So there are hundreds of billions of dollars a year of efficiencies that could come out to benefit consumers and communities.”

The Hertfordshire-based business sets its fees according to the capacity of the sites it runs and the sales they achieve. It covers the robotic hive’s running costs and typically hosts its partners’ customer-facing apps and websites. But Shaw adds: “It’s the grocers themselves who pay for the lease vehicles, the stock and the staffing. The arrangement shields Ocado from inflation and keeps it focused on extending its lead over rivals.”

Moreover, since the computing capabilities driving advances in robotics and machine learning are improving exponentially, the cost savings Ocado provides its partners should, in time, outpace less technological efficiency savings, helping it win more clients.

“Whether it’s from a lack of entrepreneurial culture or government support, the UK doesn’t have an illustrious recent history of fostering founder-based companies that go global,” says Shaw. “The fact that Tim Steiner is talking about having these CFCs spread across the world reinforces Ocado’s ambition, tenacity and vision. It’s typical of the type of company we look for: one that can gain scale that competitors struggle to challenge.”

The more fulfilment centres Ocado builds, the greater the competitive advantage it should gain. And while giant retail rivals Amazon and Walmart have their own grocery automation ambitions, it’s possible Ocado could become the market-leading technology provider as its hives of activity spread worldwide.

Hear Ocado’s chief executive Tim Steiner talk more about his plans on Scottish Mortgage’s podcast Invest in Progress.

Listen to the podcast here.

About the author - Faith Glasgow

Journalist

Faith Glasgow has been writing about personal finance and investing for almost 30 years and was editor of Money Observer until it was closed last year.

Important information

This communication was produced and approved at the time stated and may not have been updated subsequently. It represents views held at the time of production and may not reflect current thinking.

This content does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned. The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the FCA.

A Key Information Document is available by visiting our Documents page.

Any images used in this content are for illustrative purposes only.