July 2023

Article

4 minutes

Scottish Mortgage forum: why we continue to back innovation

Stewart Heggie – Commercial Director

Key Points

- A recent forum updated investors on performance, disruptive opportunities and private companies

- The Trust’s managers highlighted the need for companies to be adaptable and resilient to shocks

- They also stressed the importance of patience – which can hopefully lead to extraordinary rewards

As with any investment, your capital is at risk

Investment drives change, and change drives long-term returns. That’s the core belief that guides Scottish Mortgage’s managers on their hunt for exceptional growth companies, with the aim of investing in them for five years or longer.

The Trust’s managers Tom Slater and Lawrence Burns have stuck to this approach in the face of recent unfavourable market conditions. They have done so because they believe that only by embracing discomfort can they generate outsized returns.

The managers updated shareholders at a forum in London in June.

Reflections

Slater opened by reflecting on performance. He remarked on the fact that recent interest rate rises and the invasion of Ukraine, among other factors, had hit confidence in parts of the economy and led some companies to cut costs. This has been reflected in the Trust’s own share price.

“We are disappointed with the outcome we’ve delivered for shareholders over the past year,” Slater said.

“However, we hope you don’t own Scottish Mortgage on the basis of the outcome in any one year.”

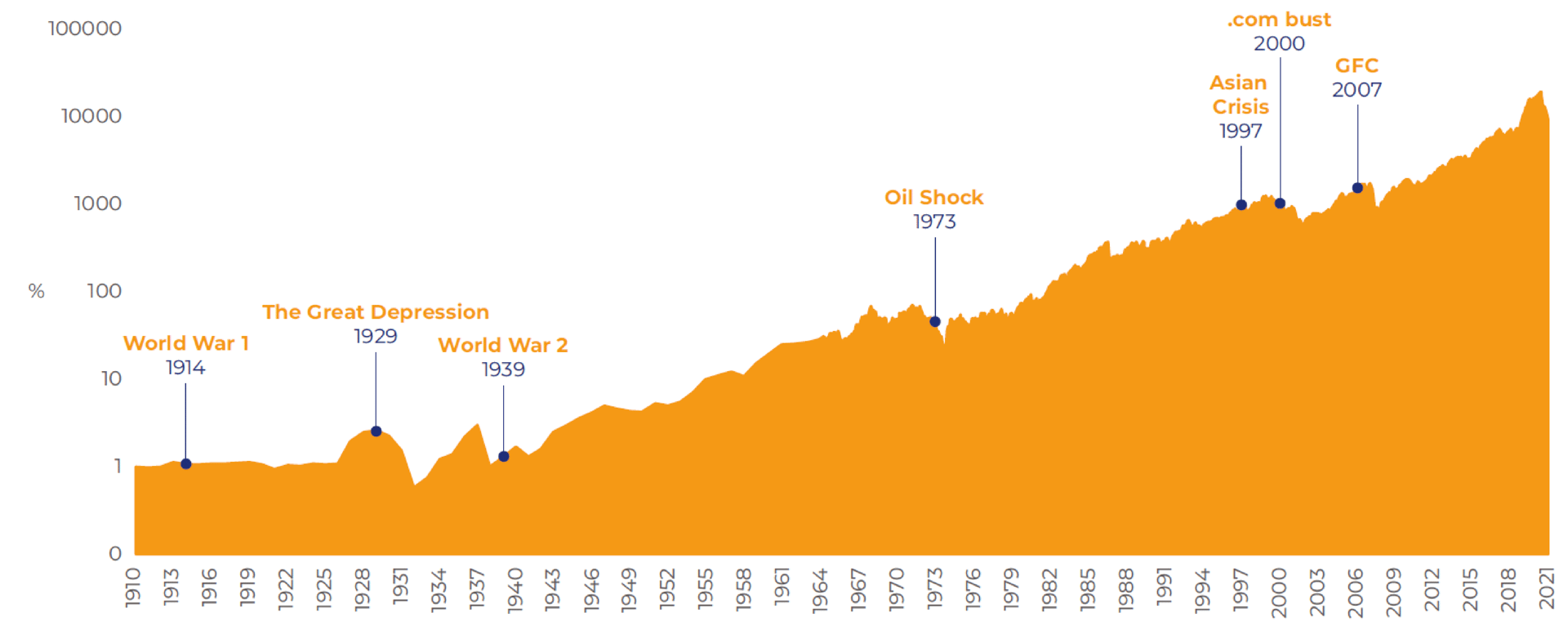

A long history

Asset value of Scottish Mortgage Investment Trust since 1910

Slater added that one of the first questions he and Burns ask, is whether the business would be resilient to external shocks and could adapt to changing conditions. And he said that the recent challenges were “predominantly transient in nature”, only rarely affecting the case for staying invested in the Trust’s portfolio companies.

Disruption opportunities

Slater explained that technological progress continued to march forward.

Disrupting industries

Innovation does not come from the ‘experts’

| Looking back | Looking ahead |

| Retail innovation It wasn’t Walmart… It was Amazon (ecommerce) |

Healthcare innovation Maybe it’s not J&J, GSK or Novartis… Maybe it’s Moderna? |

|

Media innovation |

Logistics innovation Maybe it’s not FedEx or UPS… Maybe it’s Zipline? |

| Automotive innovation It wasn’t GM/Ford/VW… It was Tesla |

Food innovation Maybe it’s not Nestle or Tyson… Maybe it’s Upside Foods? |

| Space innovation It wasn’t Boeing or Lockhead Martin… It was SpaceX |

Can you think of a major innovation in the last 4O years that has come from so called ‘experts’? |

Developments in fields as diverse as semiconductors, advanced software, genomic sequencing and cloud computing are opening up new opportunities.

He highlighted a few areas of particular excitement:

Healthcare

Scottish Mortgage’s largest holding, Moderna, became a household name thanks to its Covid-19 vaccine. It now has 30 vaccines for infectious diseases in clinical trials, as well as a personalised cancer vaccine, in the pipeline. Recent trials on advanced melanoma showed a 44 per cent increase in survival compared to the current standard of care. Meanwhile, firms such as Tempus Labs and Recursion are also developing new treatments using artificial intelligence (AI) techniques.

The energy transition

The long-term trend towards electrification continues. The US has legislated for significant investment to remain competitive with Chinese companies attempting to dominate related supply chains. Batteries will be critical – Slater quoted statistics from McKinsey predicting that the battery market would equal 4.7 terawatt-hours (TWh) in size by 2030, compared with 700 gigawatt-hours (GWh) in 2022. For comparison’s sake, that would be enough to power more than 67 million homes for a year. Firms such as the US battery recycler Redwood Materials, the electrical aircraft venture Joby Aviation and the European battery manufacturer Northvolt stand to gain. The latter has announced $55bn of contracts with car manufacturers and is scaling rapidly to meet industry needs.

Artificial intelligence

There have been several meaningful breakthroughs over the past year, most noteworthy the success of ChatGPT. AI will transform many parts of the economy. As Slater noted: “Ten years ago, Marc Andreessen characterised the investment approach of his venture capital firm with the idea that software is eating the world... The way I look at it, at this point, AI is starting to eat software.” He explained that most companies are having board-level discussions about how to inject generative AI – the ability for software to create text, images and computer code at similar levels to humans – into their business models. This is a huge opportunity for NVIDIA, the leading provider of computer chips used to train AI models, and ASML, the only firm making machines capable of manufacturing the most advanced chips.

Why private companies?

Over the last decade, private company investing has become a core part of the Scottish Mortgage approach.

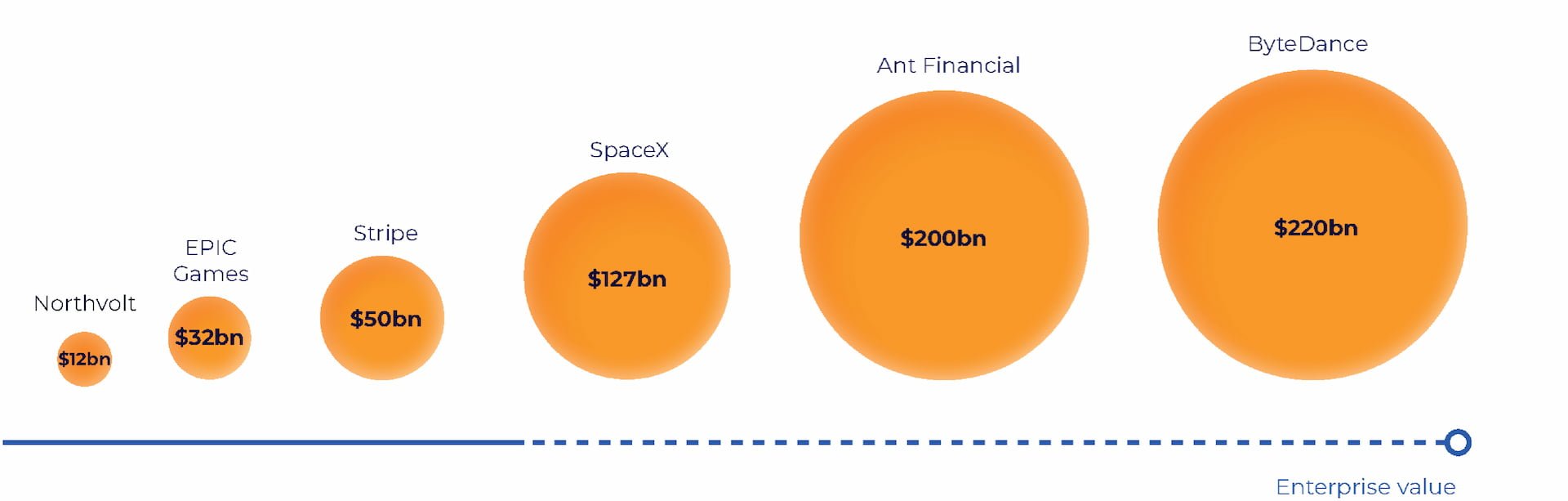

Size

Private companies in Scottish Mortgage top 30 with enterprise values over $10bn

Private companies give the Trust ‘s shareholders a chance to own exceptional businesses at a rapid growth stage, many of which have no public market equivalent. Burns outlined four further reasons to take stakes in them:

- Companies are staying private for longer. As Burns explained, “We have a number of companies that are valued at more than $100bn and have been private for quite a long time… Often we agree with [the decision to stay private], as there are a lot of drawbacks to being a public company. The companies that make up the bulk of our private exposure, therefore, are neither small nor early-stage.”

- Scottish Mortgage’s scale, structure and reputation as a patient shareholder give it an edge, which attracts the attention of private companies. “This matters,” Burns said, “because the most sought-after private companies have a long list of people that want to invest in them, and they’re able to choose who their investors are.”

- “Understanding how the world is changing solely through public companies is akin to trying to construct a puzzle with half the pieces missing,” Burns said. “I remember going to the Bay Area in 2018 and meeting startup after startup hoping to disrupt their industry by building the next big AI chip. It was that process and having access to those private companies that gave us more conviction in terms of NVIDIA’s edge.”

- Traditionally, investing in world-leading private companies has been neither accessible nor cheap. Even leading venture capital funds can find it difficult to get access, and the fees they charge their own investors are typically high. By contrast, Scottish Mortgage democratises access while taking pride in keeping its fees low.

What’s on shareholders’ minds?

As always, the forum gave attendees the opportunity to ask questions.

Burns answered one about finding private companies by explaining that three common ways involve:

- the managers scouting for potential investments by travelling to China, Latin America and India, among other regions

- founders and other private company leaders contacting Scottish Mortgage

- being recommended by existing partners – including portfolio company executives and venture capital firms Scottish Mortgage has previously invested alongside

Slater responded to a question about Elon Musk’s recent behaviour. He remarked that ordinary people rarely change the world, and that Tesla and SpaceX’s recent execution has been phenomenal. He added that while Musk often comes up with visionary ideas, he is surrounded by highly capable managers who execute them with proven operational expertise.

Slater was also quizzed about when he last “pressed the button” to buy Scottish Mortgage shares. He revealed that he had done so three weeks previously.

It’s the plainest example of the fact that, despite uncertainty over what’s happening in the market, the managers have conviction in their investments.

And Burns highlighted another important quality. “To hold the next big winners takes patience,” he said. “What we try to do is own companies where if you're patient, the reward for being so is hopefully extraordinary.”

Scottish Mortgage Annual Past Performance To 31 March each year (net %)

| 2019 | 2020 | 2021 | 2022 | 2023 |

| 16.5 | 12.7 | 99.0 | -9.5 | -33.6 |

Source: Morningstar, share price, total return, sterling.

Past performance is not a guide to future returns.

The trust invests in overseas securities. Changes in the rates of exchange may also cause the value of your investment (and any income it may pay) to go down or up.

The trust invests in emerging markets where difficulties in dealing, settlement and custody could arise, resulting in a negative impact on the value of your investment.

The trust has a significant investment in private companies. The trust’s risk could be increased as these assets may be more difficult to sell, so changes in their prices may be greater.

About the author - Stewart Heggie

Commercial Director

Stewart Heggie is a commercial director, focused on serving the needs of Scottish Mortgage shareholders. Prior to joining in 2019, he spent 15 years as a discretionary fund manager, before which he helped design the investment platform of a large UK bank. Nowadays, Stewart enjoys a varied role that spans across several areas involved in running a listed investment company. He plays a key role in developing the company’s strategic direction and broadening out its ownership. Beyond that, he works closely with the managers to maintain current portfolio knowledge; regularly meets with potential and existing overseas shareholders; and acts as a key contact for the board of directors.

Important information

This communication was produced and approved at the time stated and may not have been updated subsequently. It represents views held at the time of production and may not reflect current thinking.

This content does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned. The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the FCA.

A Key Information Document is available by visiting our Documents page.

Any images used in this content are for illustrative purposes only.