Scottish Mortgage manager review

Tom Slater – Manager, Scottish Mortgage

- Amid the economic volatility and global instability, Scottish Mortgage seeks companies that match innovation with adaptability and resilience

- Key holdings include Moderna, NVIDIA, ASML, Amazon and SpaceX, reflecting the impact of AI and technological advancements

- Scottish Mortgage continues to focus on exceptional growth companies and its long-term investment horizon

As with any investment, your capital is at risk.

We live in a world of ongoing geopolitical tensions, shifting monetary policies and disruptive technology. Against this dynamic backdrop, Scottish Mortgage remains steadfast in its mission: seeking out exceptional companies capable of delivering long-term growth and transformative change.

The volatility of economies, company profitability and our own stock price prompts the question of whether investing as we do has become riskier. We do not believe that it has. Instead, our diagnosis is that volatility reflects the world becoming a more uncertain place. We must adapt to life with greater uncertainty.

That does not mean a flight to the perceived safety of dull companies with low growth and established entry barriers. That would increase our risk profile with the world in flux. What it does mean is that for our companies to achieve their potential, they must first be resilient, and they must be able to adapt.

Events like the Covid-19 pandemic, supply chain disruptions, two global conflicts and an emerging cold war between the US and China are eroding trust in the fundamental arrangement of the economy.

People are more uncertain about trade agreements, financial structures, democratic provisions, the reasonableness of judicial decisions, and the dependability of public health provisions. This feeling of instability makes the idea of rational decision-making less reliable.

With basic economic assumptions in question, globalisation is slowing. For reasons of stability and national security, countries are hesitant to rely as heavily on foreign partners. There's a push to bring the manufacturing of critical goods and resources back within domestic control.

The US has decided that semiconductor manufacturing is far too sensitive and important to leave to China or even to Taiwan and has passed the Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act, stimulating hundreds of billions of dollars of domestic investment. Similarly, the EU, as a result of the war in Ukraine, had to bring home a lot of energy production previously farmed out to Russia.

This economic shift is a major adjustment after a long period of relative stability post-World War II. It's unclear when, or even if, the previous stability will return. The tension between China and America may prove manageable within current frameworks. There is the small but growing possibility of rupture and a move towards a multi-polar world order. There is a strong incentive for some of the world's big growing economies to seek alternatives to dollar-denominated trade.

Ongoing disruptions from technology (particularly generative artificial intelligence, covered by my partner Lawrence Burns later in this report), climate change, and geopolitics will force continued economic transformation. Optimisation and profit maximisation are desirable and rational in a settled environment, but they can be dangerous in an uncertain one. Optimised systems are brittle and can break despite even modest disruptions.

We are placing greater emphasis on resilience. Adaptability is a crucial attribute in a world of uncertainty. It is a multifaceted quality with financial components, such as high margins or strong balance sheets, and cultural elements that are equally important. Diverse organisations are more likely to contain the ingredients for success in a shifting environment than are monocultures.

This change in emphasis doesn't diminish our focus on imagining what a company will look like 10 years from now. It is an acknowledgement that businesses must face challenges in the interim as they exist today.

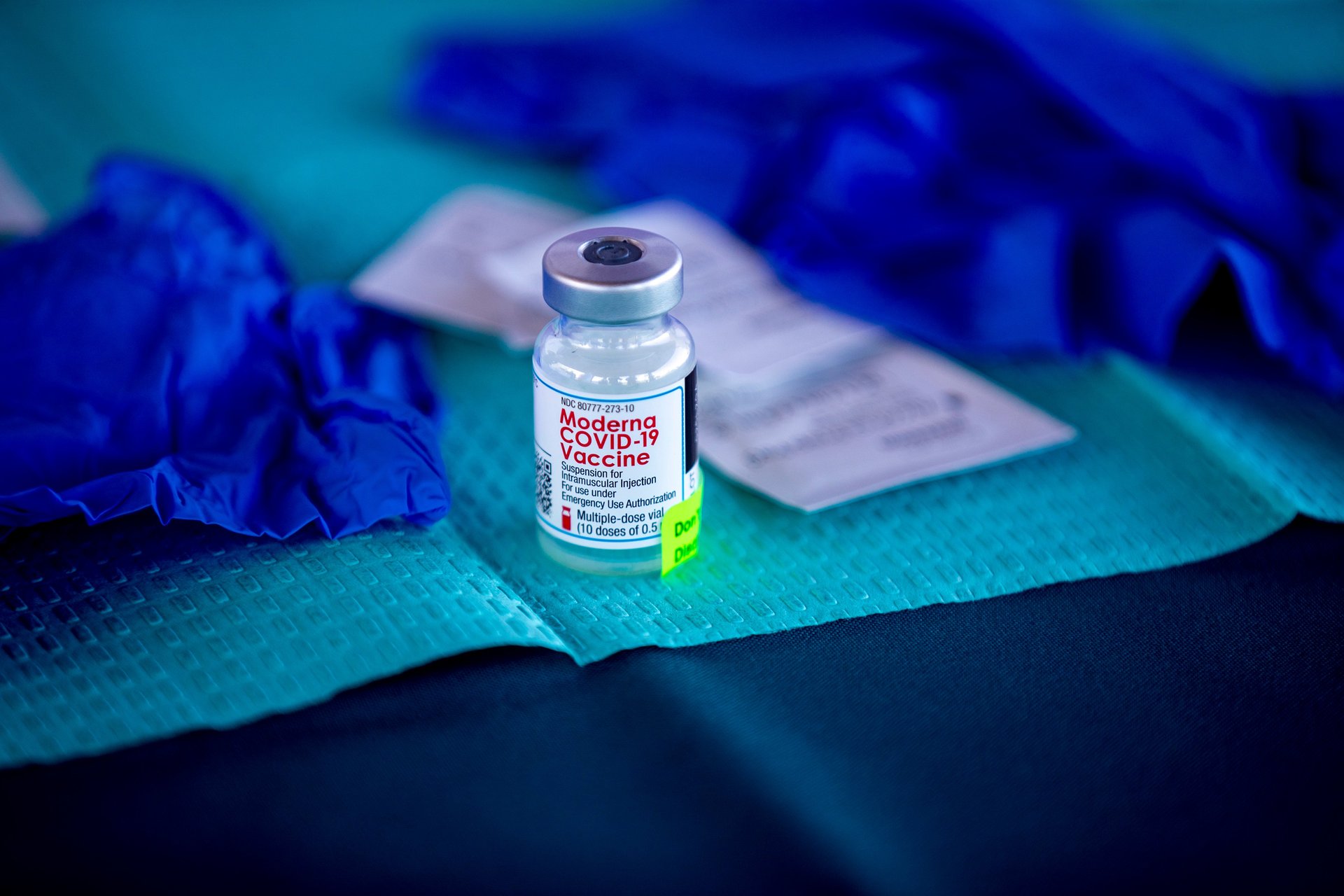

A pertinent example of this is last year's largest holding (and biggest headwind), Moderna. Vaccine fatigue has presented a challenge for the company, with vaccination levels for endemic Covid-19 well below expectations. There are several possible explanations for this, but the virus remains more lethal than influenza and vaccination rates are less than half.

Moderna is resilient in the face of these events. The windfall it received from its Covid-19 vaccine has given it a substantial cash position to fund the deployment of its technology into other areas.

Our reasons for having a significant investment in the company remain unchanged. In the near term, the company's respiratory vaccine franchise will grow. It has seen promising results from its trials of RNA-based vaccines for flu and respiratory syncytial virus (RSV) and ought to be able to combine these vaccines with Covid-19 into a single shot, which will be better for patients and cheaper for the healthcare system.

As its work on other respiratory viruses comes to fruition, it should be able to add these and update for prevalent strains to ensure maximum efficacy. Reducing hospital bed occupancy in the winter flu season will be highly beneficial.

The work the company is doing on several other viruses, such as Epstein-Barr virus (EBV) and cytomegalovirus (CMV), will help prevent these infections and, importantly, address the impact that they can have on health later in life. The data from trials of a personalised cancer vaccine that enables the body's immune system to identify cancerous cells and remove them continue to be very encouraging.

Our largest holdings, NVIDIA and ASML, are in the semiconductor industry. Demand for NVIDIA's chips has vastly exceeded expectations, which has been an important driver of our returns. Without NVIDIA’s silicon or software, we would not be seeing such remarkable progress from AI systems. Our key consideration is the duration of the edge it has built over the competition.

ASML, the Dutch manufacturer of the lithography equipment needed to produce cutting-edge semiconductors, has one of the most apparent competitive advantages we’ve ever encountered. Its innovations are the central enablers of miniaturisation in semiconductors. Growth in data centres and AI applications augment the growing demand for chips in many industries.

At the same time, chips are getting bigger, and the desire for greater sovereignty in semiconductors is fuelling demand for capital equipment. The offset to these encouraging trends is geopolitics impinging on the company's equipment sales in China. The immediate challenge is demonstrating that innovation can continue following the retirement of chief executive (CEO) Peter Wennink and president and chief technology officer Martin van den Brink.

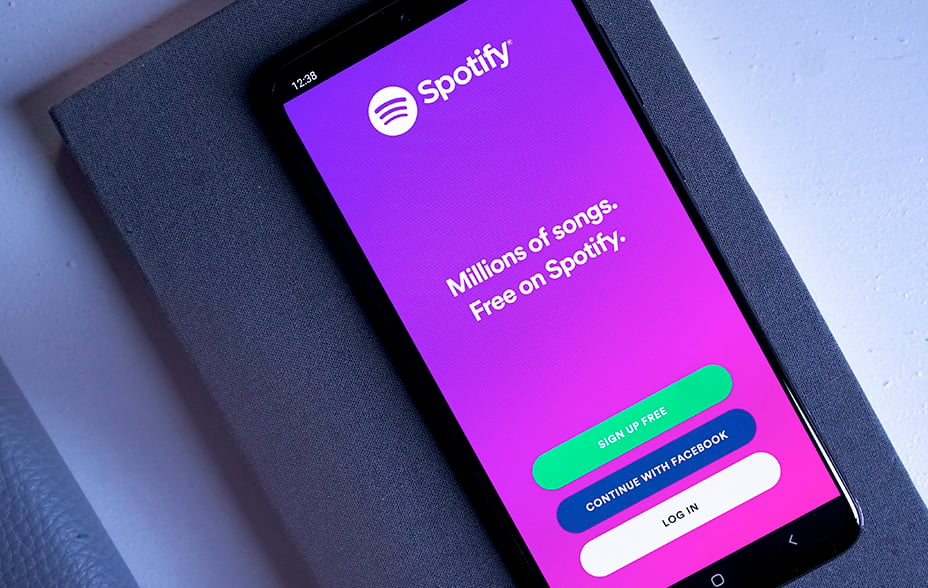

Amazon and Spotify have taken drastic action to increase their resilience in the past year, and stock markets have strongly rewarded them both. We added to Amazon, and it has regained its position as one of our top holdings. It is now reaping the benefits of substantial capacity increases made during Covid-19.

Periods of investment and cost increases at both companies have ended, and there has been a much greater focus on efficiency, reflected in margin improvement. The growth opportunities are exciting, and both exemplify the types of businesses that seem likely to benefit from developments in AI.

We are seeing many companies invest in AI systems to improve their operations but for investors, there is an essential question of whether this generates additional returns or ends up being a zero-sum game.

Spotify is a platform business that benefits from the breadth and scale of content on its platform. AI will likely lead to an explosion in available content, improving its economics in a way that others cannot mitigate. If AI revolutionises how we purchase products, this is likely to favour Amazon, the company with the most consumer data and a vast physical infrastructure for getting products to those consumers.

Tesla, which we reduced partway through the year, is at a fascinating juncture. Its recent products have been hugely successful, and preliminary sales data indicate that the Model Y was the best-selling vehicle in the world last year. However, the rise in interest rates has reduced the affordability of all high-ticket items, including Tesla vehicles, depressing demand.

At the same time, the rapid scaling of Chinese electric vehicle production, along with improving quality, is a powerful source of competition and pricing pressure. All of this may be irrelevant to the long-term investment story.

Tesla’s massive investment in AI looks to be paying off with the rapid improvement in its self-driving software. User reports on the latest version, now entirely AI-controlled, are very favourable, and the company is installing it in all new US vehicles. Tesla is harnessing the same investments to produce humanoid robots, whose capabilities are progressing along an exponential trajectory.

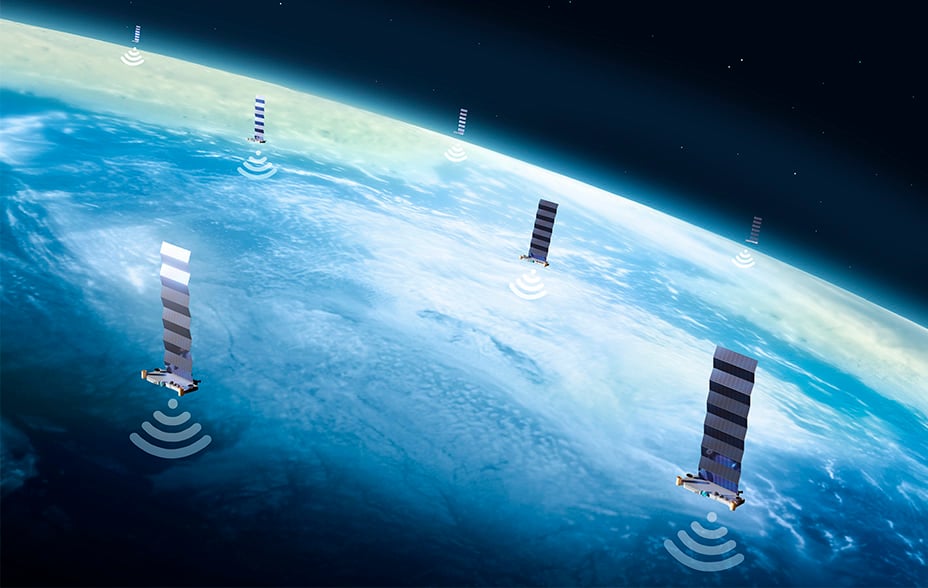

Our largest private position, SpaceX, now a bigger holding than Tesla, launched 96 rockets last year (accounting for two-thirds of all commercial launches). It has no peers when it comes to scale and cost efficiency. The company’s latest rocket, Starship, has unprecedented capabilities and will transport 150 metric tonnes of payload. It is close to commercial launch.

Starlink, the satellite communications subsidiary, has 2.3 million subscribers and is growing rapidly bringing connectivity to underserved parts of the world. Its unique access to launch capacity puts it way ahead of potential competitors. It already has sufficient scale to generate cash.

There has been little change elsewhere in our private portfolio. Our top 10 private holdings represent approximately two-thirds of our private exposure, and the operating performance of these companies has been encouraging. We selectively supported holdings that raised money in the year. With financial market activity subdued, very few companies moved from private to public markets.

The combination of a weak domestic economy, an uncertain regulatory environment and geopolitical concerns have made the inclusion criteria for Chinese stocks in the portfolio more demanding. However, the vast domestic market and exceptional entrepreneurs mean we continue to take Chinese investments seriously.

Ecommerce giant Pinduoduo has a proven track record of building a discount retail offering in China and turning it into a profitable business. It is now attempting the same thing overseas, and the pace of rollout for its platform, Temu, has been very impressive. The international pattern of profitability is tracking what we have seen previously in China. We added to Meituan, the local services company, which has proven leadership and the scope for meaningful profit growth in the years to come.

We have sold our position in Tencent, the Chinese mobile platform, which has been a prominent holding for us over the past 15 years (a transaction which completed after the year-end date). We have massive respect for the team there, who have proven to be phenomenal operators and astute investors.

We think that ongoing political and regulatory developments mean that the constraints that go with scale for Chinese businesses have increased substantially. As a result, it will be difficult for Tencent to meet our more demanding inclusion criteria over the coming years.

We also sold another long-standing holding, Illumina. We believe that genomic sequencing is a fundamental building block for improving healthcare in the coming decades. However, the company's execution could have been better, and the work required to drive demand and lower costs will be challenging for some time.

Several other holdings are utilising genomic sequencing to improve health outcomes. The progress made by Tempus in using sequencing data to guide the treatment of US cancer patients is impressive, and potential applications of the approach continue to multiply.

There is a lot to be excited about. Artificial intelligence, digitalisation, scientific and engineering progress, and the opportunities presented by transitioning our energy model will provide fertile investment territory for years to come.

Jeff Bezos stressed the importance of focusing on the things that don't change as you build a business. For Scottish Mortgage, that means seeking the most exceptional growth companies, being patient and constructive owners, and harnessing the outsized impact of the small number of extraordinary companies to drive our returns.

Annual Past Performance To 31 March each year (net%)

| 2020 | 2021 | 2022 | 2023 | 2024 | |

| Scottish Mortgage Investment Trust plc | 12.7 | 99.0 | -9.5 | -33.6 | 32.5 |

Source: Morningstar, share price, total return, sterling.

Risk factors

The trust invests in overseas securities. Changes in the rates of exchange may also cause the value of your investment (and any income it may pay) to go down or up.

Unlisted investments such as private companies, in which the Trust has a significant investment, can increase risk. These assets may be more difficult to sell, so changes in their prices may be greater.

The Trust invests in emerging markets, which includes China, where difficulties with market volatility, political and economic instability including the risk of market shutdown, trading, liquidity, settlement, corporate governance, regulation, legislation and taxation could arise, resulting in a negative impact on the value of your investment.

About the author - Tom Slater

Manager, Scottish Mortgage

Tom Slater is manager of Scottish Mortgage. He joined Baillie Gifford in 2000 and became a partner of the firm in 2012. Tom joined the Scottish Mortgage team as deputy manager in 2009, before assuming the role of Manager in 2015. Beyond that, he is the head of the US Equities team and a member of another long-term growth equity strategy. During his time at Baillie Gifford, Tom has also worked in the Developed Asia and UK Equity teams. Tom’s investment interest is focused on high-growth companies both in listed equity markets and as an investor in private companies. He graduated BSc in Computer Science with Mathematics from the University of Edinburgh in 2000.

Regulatory Information

This content was produced and approved at the time stated and may not have been updated subsequently. It represents views held at the time of production and may not reflect current thinking. Read our Legal and regulatory information for further details.

A Key Information Document is available by visiting our Documents page. Any images used in this content are for illustrative purposes only.

This content does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned. The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the FCA.

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 (BGA) holds a Type 1 licence from the Securities and Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes and closed-ended funds such as investment trusts to professional investors in Hong Kong.

Baillie Gifford Asia (Singapore) Private Limited (BGAS) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. BGA and BGAS are wholly owned subsidiaries of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co.

Europe

Scottish Mortgage Investment Trust PLC (the “Company”) is an alternative investment fund for the purpose of Directive 2011/61/EU (the “AIFM Directive”). Baillie Gifford & Co Limited is the alternative investment fund manager (“AIFM”) of the Company and has been authorised for marketing to Professional Investors in this jurisdiction.

This content is made available by Baillie Gifford Investment Management (Europe) Limited (“BGE”), which has been engaged by the AIFM to carry out promotional activities relating to the Company. BGE is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform promotional, advisory and Individual Portfolio Management activities. BGE has passported its authorisations under the mechanisms set out in the AIFM Directive.

Belgium

The Company has not been and will not be registered with the Belgian Financial Services and Markets Authority (Autoriteit voor Financiële Diensten en Markten / Autorité des services et marchés financiers) (the FSMA) as a public foreign alternative collective investment scheme under Article 259 of the Belgian Law of 19 April 2014 on alternative collective investment institutions and their managers (the Law of 19 April 2014). The shares in the Company will be marketed in Belgium to professional investors within the meaning the Law of 19 April 2014 only. Any offering material relating to the offering has not been, and will not be, approved by the FSMA pursuant to the Belgian laws and regulations applicable to the public offering of securities. Accordingly, this offering as well as any documents and materials relating to the offering may not be advertised, offered or distributed in any other way, directly or indirectly, to any other person located and/or resident in Belgium other than to professional investors within the meaning the Law of 19 April 2014 and in circumstances which do not constitute an offer to the public pursuant to the Law of 19 April 2014. The shares offered by the Company shall not, whether directly or indirectly, be marketed, offered, sold, transferred or delivered in Belgium to any individual or legal entity other than to professional investors within the meaning the Law of 19 April 2014 or than to investors having a minimum investment of at least EUR 250,000 per investor.

Germany

The Trust has not offered or placed and will not offer or place or sell, directly or indirectly, units/shares to retail investors or semi-professional investors in Germany, i.e. investors which do not qualify as professional investors as defined in sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB) and has not distributed and will not distribute or cause to be distributed to such retail or semi-professional investor in Germany, this document or any other offering material relating to the units/shares of the Trust and that such offers, placements, sales and distributions have been and will be made in Germany only to professional investors within the meaning of sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB).

Luxembourg

Units/shares/interests of the Trust may only be offered or sold in the Grand Duchy of Luxembourg (Luxembourg) to professional investors within the meaning of Luxembourg act by the act of 12 July 2013 on alternative investment fund managers (the AIFM Act). This document does not constitute an offer, an invitation or a solicitation for any investment or subscription for the units/shares/interests of the Trust by retail investors in Luxembourg. Any person who is in possession of this document is hereby notified that no action has or will be taken that would allow a direct or indirect offering or placement of the units/shares/interests of the Trust to retail investors in Luxembourg.

Switzerland

The Trust has not been approved by the Swiss Financial Market Supervisory Authority (“FINMA”) for offering to non-qualified investors pursuant to Art. 120 para. 1 of the Swiss Federal Act on Collective Investment Schemes of 23 June 2006, as amended (“CISA”). Accordingly, the interests in the Trust may only be offered or advertised, and this document may only be made available, in Switzerland to qualified investors within the meaning of CISA. Investors in the Trust do not benefit from the specific investor protection provided by CISA and the supervision by the FINMA in connection with the approval for offering.

Singapore

This content has not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this content and any other content or material in connection with the offer or sale, or invitation for subscription or purchase, of the Trust may not be circulated or distributed, nor may be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor (as defined in Section 4A of the Securities and Futures Act 2001, as modified or amended from time to time (SFA)) pursuant to Section 274 of the SFA, (ii) to a relevant person (as defined in Section 275(2) of the SFA) pursuant to Section 275(1), or any person pursuant to Section 275(1A), and in accordance with the conditions specified in Section 275 of the SFA, or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Where the Trust is subscribed or purchased under Section 275 by a relevant person which is:

(a) a corporation (which is not an accredited investor (as defined in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or

(b) a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary of the trust is an individual who is an accredited investor, securities or securities-based derivatives contracts (each term as defined in Section 2(1) of the SFA) of that corporation or the beneficiaries’ rights and interest (howsoever described) in that trust shall not be transferred within six months after that corporation or that trust has acquired the securities pursuant to an offer made under Section 275 except:

(1) to an institutional investor or to a relevant person or to any person arising from an offer referred to in Section 275(1A) or Section 276(4)(c)(ii) of the SFA,

(2) where no consideration is or will be given for the transfer;

(3) where the transfer is by operation of law; or

(4) pursuant to Section 276(7) of the SFA or Regulation 37A of the Securities and Futures (Offers of Investments) (Securities and Securities-based Derivatives Contracts) Regulations 2018.