November 2024

Article

5 minutes

Tempus AI: the future of cancer care

Claire Shaw – Portfolio Director

Key points

- AI is transforming cancer care by enhancing diagnostics, finding new treatment options and improving care

- AI’s ability to interrogate images at speed offers hope of more timely and accurate diagnoses than current methods

- Tempus AI’s vast clinical and genomic data library aids in cancer research, diagnostics and treatment, presenting a significant growth opportunity

As with any investment, your capital is at risk.

In the fight against cancer, artificial intelligence (AI) is a growing area of interest.

Researchers believe that AI will positively impact the fight against cancer in numerous ways.

Artificial intelligence will:

Tempus AI: the future of cancer care

Cancer research has evolved significantly since a surgeon performed the first mastectomy to treat breast cancer in 1882. By 1950 researchers had linked smoking to lung cancer and in 2010, the US Food and Drug Administration approved a vaccine to treat prostate cancer.

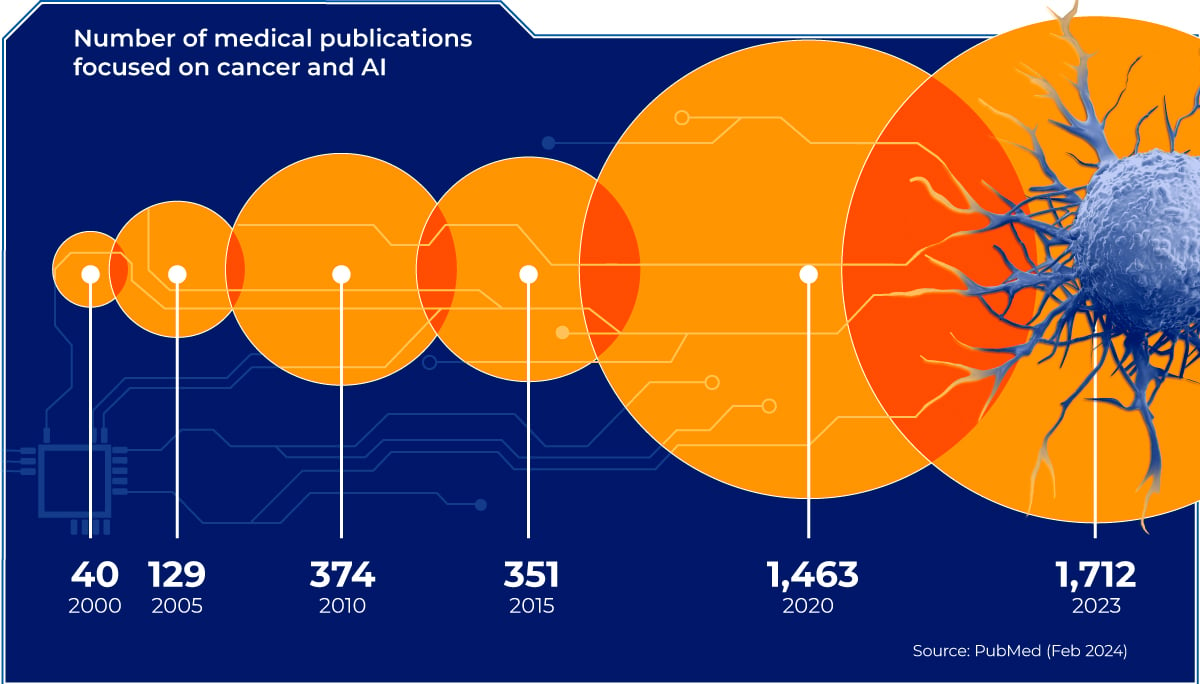

Now, there is another weapon to help fight cancer: artificial intelligence (AI). The volume of scientific literature that covers both AI and cancer has grown substantially over the past two decades, from a small handful in the early 2000s to nearly two thousand in 2022.

What difference can AI make?

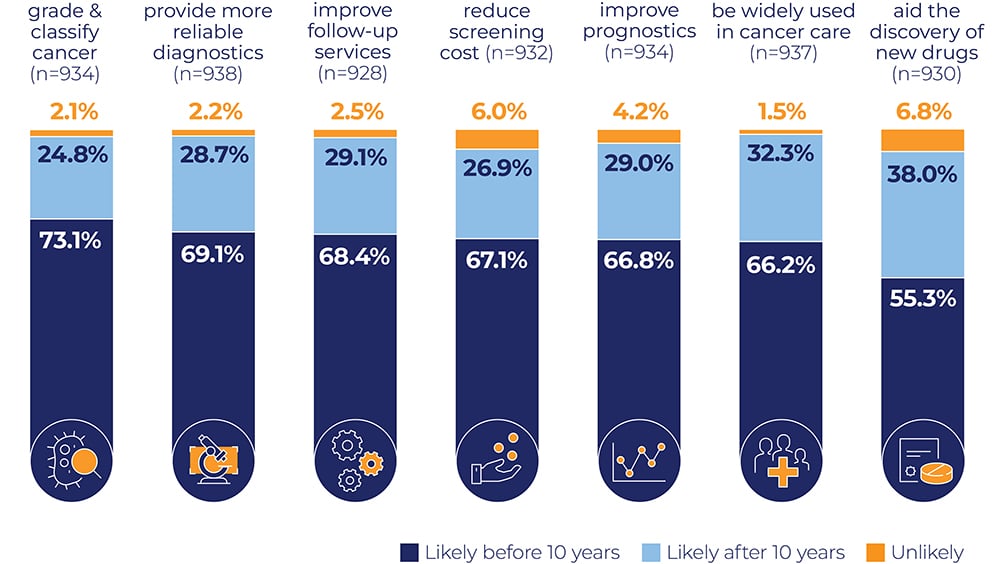

A 2023 study asked authors of peer-reviewed scientific articles on AI and cancer about where AI would have the most impact on the fight against cancer. There was wide agreement that even within the next decade it would inform everything from discovering new cancer treatments to diagnostics and cancer care.

Above all, researchers expect AI to have the most significant near-term impact on grading and classifying cancer through image analysis. A cancer’s grade refers to how abnormal the cell looks, which gives clinicians a better understanding of the disease’s progression.

Following this, researchers believe AI will provide more reliable diagnostics. Cancer research published in November 2023 appears to support these beliefs. It demonstrated that AI flagged up to 18 per cent more early-stage breast cancer than doctors identified.

This suggests that AI has the potential to spot a significant amount of the 20 per cent or more of cancers that are estimated to be missed during current non-AI screening. Excitingly, the AI tool required only half the time a human would typically spend reading a breast cancer scan, offering hope of more timely diagnoses.

The future of cancer

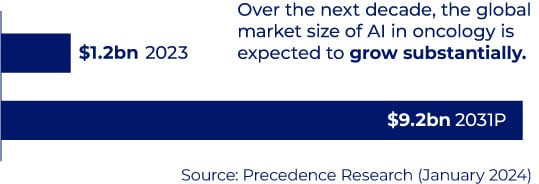

Analysts project that the global market size of AI in oncology could grow from $891mn in 2022 to $10.7bn in 2032. As the owner of the world’s largest library of clinical and genomic data, including a database of over 6 million patient records, Tempus is well-positioned to capitalise on this opportunity.

Tempus is doing so by taking large and complex datasets and making them easier for researchers and clinical staff to access and explore. This is necessary because the data held on medical records is largely unstructured making it difficult to pull out useful information without the help of AI.

Tempus uses AI to process the records in its database so that medical staff can interrogate them and better diagnose and treat cancer and other diseases.

However, it is not just clinicians that benefit from the insights generated by its AI-driven database, as it should also improve cancer research and the discovery of new drugs and treatment options.

Pharmaceutical companies that subscribe to its data library can better understand how effective their current treatments are and find potential new cancer treatments. The overall penetration of Tempus’ tests remains low, which could lead to a persuasive long-term growth opportunity for the company.

Tempus sits at the intersection of two exciting trends – genomic profiling and artificial intelligence-driven health data. By advancing precision medicine through the practical application of AI in healthcare, Tempus equips the medical research community and allows physicians to make near real-time, data-driven decisions to deliver personalised patient care.

Scottish Mortgage first invested in Tempus AI as a private company in 2018. It listed on the NASDAQ in June 2024, raising over $400mn at a valuation of over $6bn.

Looking forward, we remain excited by the company. We maintain a high conviction in its ability to offer extreme long-term returns, by using AI to transform cancer care.

This infographic was produced in collaboration with Visual Capitalist.

PubMed data shows the number of publications where cancer and AI are both a major topic, using the following search: (neoplasms[majr] NOT benign) AND (artificial intelligence[majr]). Data for the second chart is from Cabral et al. (2023). Future of Artificial Intelligence Applications in Cancer Care: A Global Cross-Sectional Survey of Researchers. Current Oncology 30(3), 3432-3446. The Cabral et al. survey was conducted between 24 October - 4 November 2022 with researchers who had published an article on AI and cancer between 20 September 2020 and 20 September 2022. Numbers may not sum to 100 due to rounding.

About the author - Claire Shaw

Portfolio Director

Claire Shaw is a portfolio director and plays a prominent role in servicing Scottish Mortgage’s UK shareholder base. Before joining in 2019, she spent over a decade as a fund manager with a focus on managing European equity portfolios for a global client base. With a background in analysing companies and communicating investment ideas, Claire is also responsible for creating engaging content that makes the Scottish Mortgage portfolio accessible to all its shareholders. Beyond that, she works closely with the managers, meeting with portfolio companies and conducting in-depth portfolio discussions with shareholders.

Important information

This communication was produced and approved at the time stated and may not have been updated subsequently. It represents views held at the time of production and may not reflect current thinking.

This content does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned. The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the FCA.

A Key Information Document is available by visiting our Documents page.

Any images used in this content are for illustrative purposes only.