Blockchain.com: Building Crypto’s Financial Future

- Private company Blockchain.com provides a way for people and institutions to buy, sell and store bitcoins and other digital tokens

- Scottish Mortgage has been a shareholder since 2021

- The crypto company's reputation, resilience and potential to play a disruptive role in finance merit its inclusion in the portfolio

As with any investment, your capital is at risk.

A good reputation is always an asset, but its importance is hard to exaggerate in the world of crypto. The market for bitcoin and other crypto tokens* has swelled to over $3tn, but a series of scams and scandals has rightly put investors on guard. So, it’s little wonder that Blockchain.com’s track record and scale work well to its advantage.

The private company runs one of the world’s oldest and most widely used platforms to store, trade and track cryptocurrencies and explore their underlying technologies. Since its 2011 launch, customers have transacted more than $1tn via the firm, which currently counts 37 million verified users worldwide.

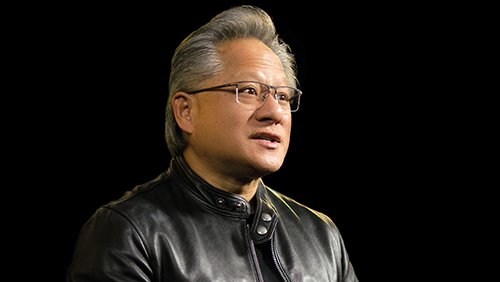

“We build products and tools that make it easy for people to be part of the crypto-financial system,” co-founder and chief executive Peter Smith tells Scottish Mortgage investment manager Tom Slater in the latest edition of the Trust’s Invest in Progress podcast.

Co-Founder and CEO of Blockchain.com, Peter Smith, on how his company has emerged through the crypto storm in a stronger position than before, on the latest episode of Invest in Progress.

Listen to the podcast here.

Smith defines its mission in terms of freedom and choice. The former, he says, is about letting anyone arrange a financial transaction with anyone else. “It doesn’t matter if I’m in Kenya and you’re in South Korea or sitting next to each other, we can economically interact.”

The latter, he adds, is about broadening the range of assets people can own. “The dollar and the pound are relatively stable currencies [but there are] places with much less stable systems, like Uganda, where most banks go bankrupt in a 15-year period and the Ugandan shilling basically inflates away everyone’s net worth.

“One of the problems I wanted to solve was giving everyone, everywhere in the world, the ability to have the same financial access and financial choices that so many of us in the west are blessed to be born with.”

Blockchain.com doesn’t only serve individuals. Since 2017, the firm has also targeted institutional clients, including banks, hedge funds and family offices.

Smith says this side of the market outpaced its consumer counterpart in terms of growth in 2024, though that was likely a temporary phenomenon. In any case, he says, serving both types of clients achieves the same goal.

“At the end of the day, institutions are just collectives of consumers,” he explains. “All of the money eventually comes back to people somewhere, somehow. However long and winding that pathway is.”

Building Trust

Providing easy access is only half the story. Smith acknowledges that in his industry, more than most, trust is “paramount”.

The failure of one of Blockchain.com’s competitors in late 2022 cast a dark cloud over crypto. FTX’s chief executive, Sam Bankman-Fried, was subsequently sentenced to 25 years in jail for stealing $8bn from customers.

“You can quickly lose trust, but you can't quickly build it,” Smith says.

“One of the things that I’m most proud of in my 10-plus years as CEO is that we’ve never broken a trade, we’ve never not honoured a withdrawal.

“In the depths of the [FTX] crisis, we had a lot of customers email us saying: ‘Do you have all our money?’. We actually sent a customer-wide email and said – click this one button, and all your money goes from our custody to your custody.”

He adds that he recognised this could have prompted an “exodus of funds”, but it was more important to retain clients’ confidence.

“About 10 per cent of customers hit that button,” he recalls. “But we got even more money deposited back into the platform as people saw that they could withdraw their money trivially.

“Trust is built slowly by doing the right thing day after day, year after year.”

A tie-up with the Dallas Cowboys American football team demonstrates the advantage of having an outstanding reputation. The deal, signed in 2022, means Blockchain.com's brand is highly visible at sporting events and across advertising.

"It is a pretty powerful endorsement from one of the biggest sports brands in the US," says Smith.

"The National Football League had to approve companies to become sponsors of teams. We’re the only NFL sponsor from the crypto industry. I think half a dozen companies tried."

A New Era

Crypto’s future appears brighter thanks to the White House’s recent change of guard. While Joe Biden’s presidency focused on restrictions and risk mitigation, Donald Trump has pledged to make the US “the crypto capital of the planet” and even suggested building up a “strategic national bitcoin stockpile”.

“It really is a whole new world, a whole new market with the Trump administration,” says Smith.

“I think that you’ll be able to get banking. I think you’ll be able to serve more customers. I think you’ll be able to get away from the patchwork of [state-based] licences that you have today to be a crypto company in the US and towards a federal charter.

“My guess is that it more or less changes almost everything about how the crypto market looks.”

Scottish Mortgage first invested in Blockchain.com in April 2021. About half a year later, the crypto industry entered a severe downturn. Bitcoin tumbled more than 75 per cent against the dollar, and the so-called ‘stablecoin’ Terra collapsed, causing bankruptcies and chaos, in addition to FTX’s blow-up.

Blockchain.com demonstrated strong resilience in its handling of this turmoil. Scottish Mortgage has since participated in two more funding rounds. At 2024’s end, the holding represented about 1 per cent of the Trust’s portfolio and is one of its 10 largest private companies.

“It's not even that many of them failed, it’s most,” Smith remarks of the crypto casualties that have amassed over the years. “When we look at it statistically, it's like seven out of 10.

“We have managed to survive three of these crypto winters for a few reasons. The first is that we’re very committed to the long term.

“A lot of the companies that you see go bankrupt are really doing short-term things, trying to get rich quickly, trying to grow too fast. We are very, very long-term oriented – that’s something that we share a lot in common with Baillie Gifford.

“The second thing is that we were very fortunate to have great people around us in terms of the board, really experienced folks who know a lot about risk management.

“The third thing is that a lot of times, the reaction from the folks that failed was far too slow. They were too slow to cut costs, too slow to cut risk.

“We had the benefit of having lived through these before, and so we knew as soon as things looked darker than expected that we needed to be incredibly aggressive about responding to it.”

The shakeout arguably left the company in a fitter state and with less competition as it headed into the subsequent upturn. And, as manager Tom Slater reflects at the podcast’s conclusion, Blockchain.com’s investment appeal remains its potential to “produce extreme returns” by “building the financial infrastructure of the future”.

* In simple terms, cryptocurrencies and other crypto assets are cryptographically secured digital tokens representing real-world value operated via a blockchain-based, distributed ledger rather than a central database. Blockchain.com has a primer on bitcoin and other cryptocurrencies on its site.

Risk Factors

Unlisted investments such as private companies, in which the Trust has a significant investment, can increase risk. These assets may be more difficult to sell, so changes in their prices may be greater.

The trust invests in overseas securities. Changes in the rates of exchange may also cause

the value of your investment (and any income it may pay) to go down or up.

Regulatory Information

This content was produced and approved at the time stated and may not have been updated subsequently. It represents views held at the time of production and may not reflect current thinking. Read our Legal and regulatory information for further details.

A Key Information Document is available by visiting our Documents page. Any images used in this content are for illustrative purposes only.

This content does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned. The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the FCA.

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 (BGA) holds a Type 1 licence from the Securities and Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes and closed-ended funds such as investment trusts to professional investors in Hong Kong.

Baillie Gifford Asia (Singapore) Private Limited (BGAS) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. BGA and BGAS are wholly owned subsidiaries of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co.

Europe

Scottish Mortgage Investment Trust PLC (the “Company”) is an alternative investment fund for the purpose of Directive 2011/61/EU (the “AIFM Directive”). Baillie Gifford & Co Limited is the alternative investment fund manager (“AIFM”) of the Company and has been authorised for marketing to Professional Investors in this jurisdiction.

This content is made available by Baillie Gifford Investment Management (Europe) Limited (“BGE”), which has been engaged by the AIFM to carry out promotional activities relating to the Company. BGE is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform promotional, advisory and Individual Portfolio Management activities. BGE has passported its authorisations under the mechanisms set out in the AIFM Directive.

Belgium

The Company has not been and will not be registered with the Belgian Financial Services and Markets Authority (Autoriteit voor Financiële Diensten en Markten / Autorité des services et marchés financiers) (the FSMA) as a public foreign alternative collective investment scheme under Article 259 of the Belgian Law of 19 April 2014 on alternative collective investment institutions and their managers (the Law of 19 April 2014). The shares in the Company will be marketed in Belgium to professional investors within the meaning the Law of 19 April 2014 only. Any offering material relating to the offering has not been, and will not be, approved by the FSMA pursuant to the Belgian laws and regulations applicable to the public offering of securities. Accordingly, this offering as well as any documents and materials relating to the offering may not be advertised, offered or distributed in any other way, directly or indirectly, to any other person located and/or resident in Belgium other than to professional investors within the meaning the Law of 19 April 2014 and in circumstances which do not constitute an offer to the public pursuant to the Law of 19 April 2014. The shares offered by the Company shall not, whether directly or indirectly, be marketed, offered, sold, transferred or delivered in Belgium to any individual or legal entity other than to professional investors within the meaning the Law of 19 April 2014 or than to investors having a minimum investment of at least EUR 250,000 per investor.

Germany

The Trust has not offered or placed and will not offer or place or sell, directly or indirectly, units/shares to retail investors or semi-professional investors in Germany, i.e. investors which do not qualify as professional investors as defined in sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB) and has not distributed and will not distribute or cause to be distributed to such retail or semi-professional investor in Germany, this document or any other offering material relating to the units/shares of the Trust and that such offers, placements, sales and distributions have been and will be made in Germany only to professional investors within the meaning of sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB).

Luxembourg

Units/shares/interests of the Trust may only be offered or sold in the Grand Duchy of Luxembourg (Luxembourg) to professional investors within the meaning of Luxembourg act by the act of 12 July 2013 on alternative investment fund managers (the AIFM Act). This document does not constitute an offer, an invitation or a solicitation for any investment or subscription for the units/shares/interests of the Trust by retail investors in Luxembourg. Any person who is in possession of this document is hereby notified that no action has or will be taken that would allow a direct or indirect offering or placement of the units/shares/interests of the Trust to retail investors in Luxembourg.

Switzerland

The Trust has not been approved by the Swiss Financial Market Supervisory Authority (“FINMA”) for offering to non-qualified investors pursuant to Art. 120 para. 1 of the Swiss Federal Act on Collective Investment Schemes of 23 June 2006, as amended (“CISA”). Accordingly, the interests in the Trust may only be offered or advertised, and this document may only be made available, in Switzerland to qualified investors within the meaning of CISA. Investors in the Trust do not benefit from the specific investor protection provided by CISA and the supervision by the FINMA in connection with the approval for offering.

Singapore

This content has not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this content and any other content or material in connection with the offer or sale, or invitation for subscription or purchase, of the Trust may not be circulated or distributed, nor may be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor (as defined in Section 4A of the Securities and Futures Act 2001, as modified or amended from time to time (SFA)) pursuant to Section 274 of the SFA, (ii) to a relevant person (as defined in Section 275(2) of the SFA) pursuant to Section 275(1), or any person pursuant to Section 275(1A), and in accordance with the conditions specified in Section 275 of the SFA, or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Where the Trust is subscribed or purchased under Section 275 by a relevant person which is:

(a) a corporation (which is not an accredited investor (as defined in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or

(b) a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary of the trust is an individual who is an accredited investor, securities or securities-based derivatives contracts (each term as defined in Section 2(1) of the SFA) of that corporation or the beneficiaries’ rights and interest (howsoever described) in that trust shall not be transferred within six months after that corporation or that trust has acquired the securities pursuant to an offer made under Section 275 except:

(1) to an institutional investor or to a relevant person or to any person arising from an offer referred to in Section 275(1A) or Section 276(4)(c)(ii) of the SFA,

(2) where no consideration is or will be given for the transfer;

(3) where the transfer is by operation of law; or

(4) pursuant to Section 276(7) of the SFA or Regulation 37A of the Securities and Futures (Offers of Investments) (Securities and Securities-based Derivatives Contracts) Regulations 2018.